Becca:

[0:01] Welcome to Vaginance -we’re very happy to be here.

So in this episode, you’ll hear us talk a lot about health insurance and our personal health experiences and investment experiences.

And I would just like to remind our listeners that we’re not experts and we are not offering actual advice.

We’re discussing our personal experiences.

Maggie:

[0:23] And maybe you could relate. Who knows? But don’t do things that we say to do ever.

Becca:

[0:25] Who knows?

Taylor:

[0:30] Kids, don’t buy drugs online.

Becca:

[0:32] Don’t buy drugs online unless you have a friend who just swears by a certain website.

Jewels:

[0:38] Hahahaha.

Becca:

[0:39] So both me and Taylor signed up for health care this week, and one of the things she signed up for – you already know, of course, was by your recommendation.

Taylor:

[0:42] Mhm.

Becca:

[0:47] So I think it be cool if yall maybe talked about that a little bit, because it is – I’ve already recommended that to someone. I was like, ‘You got to fucking do it. It’s amazing.’

Taylor:

[0:49] Direct direct primary care.

Maggie:

[0:50] Right.

Taylor:

[0:53] Mhm.

Maggie:

[0:54] Yeah, you might know more about at this point than I do because I literally just sent that one article.

Taylor:

[0:57] Yeah, I did a bunch of research in it, into it after you had sent me that article. So.

Becca:

[0:57] Yeah, yeah, yeah.

And I was on the fence between getting insurance through my job, which paid- which is three times more expensive or doing that.

Taylor:

[1:09] Mhm.

Becca:

[1:10] Um, so we were both in it for, like, a day and then quickly made – had to make decisions.

Taylor:

[1:15] Yeah. Should we start with our accomplishments of the week?

Taylor:

[1:20] Like, if we accomplished any of the goals we had set for ourselves last week? Did we not? Did we not set goals last week?

Becca:

[1:24] Um

I don’t think so. Well, you’re just saying, ‘Can I talk about what I did this week?’

Maggie:

[1:27] I don’t think I wrote any down.

Taylor:

[1:28] Well, I accomplished a goal. I.

Jewels:

[1:33] Taylor tell us about your successes this week .Whoa!

Taylor:

[1:35] Listen up, bitches. I finished Your Money or Your Life. My goal -Yeah. My goal from before the first podcast recording. Highly recommend.

Maggie:

[1:44] A weight off your shoulders.

Becca:

[1:50] Y’all should really try it.

Taylor:

[1:51] Y’all really should have convinced me to read this book sooner.

Maggie:

[1:52] Yeah.

Becca:

[1:58] Um, Vicki Robin, we’d love to have you on the show.

Maggie:

[1:59] I also this, this may be a good thing or a bad thing, but I do now fully recognize and am self conscious about us talking about the same book for six podcasts now.

Taylor:

[2:13] There’s a lot to cover in that book.

Maggie:

[2:14] There’s there is a lot to cover, but like, there are other books in the world too.

Taylor:

[2:17] Yeah, I know. We should probably read them.

Becca:

[2:20] Yeah, I started the 80/20 Principle. Yeah, it’s fine. So-

Maggie:

[2:23] Oh, how are you liking it so far?

Taylor:

[2:27] It’s fine.

Becca:

[2:27] So dismissive.

Maggie:

[2:27] ‘Yeah, it’s fine. Anyway, back to Your Money or Your Life.

Becca:

[2:33] The reason that sounded so dismissive is I’m only 20 minutes in, so I can’t start to make any judgment, but it’s also not the -.

Maggie:

[2:39] That’s where 80% of the information is.

Taylor:

[2:46] That is the best joke I’ve ever heard.

Becca:

[2:46] Incredible.

[2:54] You heard it. You heard it here first guys.

Taylor:

[2:55] Yeah, yeah, oh my god, I’m dying.

Becca:

[3:00] Yeah. Great alley-oop.

Um, but it’s not called the 80/20 Principle. It’s called the 80/20 Principle in 92 Other Powerful Laws of Nature. Is that, I mean, it’s by – yeah, it’s still Richard. He says it’s “Koch”.

Jewels:

[3:12] Nope. Nope. That’s another book. Same author, Coshe Cosh. Cash cock. Cotchy.

Becca:

[3:19] We know. Yeah.

Jewels:

[3:23] Um, that is another book by him.

Becca:

[3:23] Well, it was misleading. It’s the only one that the library has through the library.

So.

Jewels:

[3:30] That’s fair, but we’re making it a nice habit around here to read the wrong book.

Becca:

[3:34] That is wildly misleading. It is the same title and author.

Taylor:

[3:41] Listen, that’s that’s my argument too.

Becca:

[3:43] This is way different.

Maggie:

[3:46] Uh, Taylor’s like, “That’s my thing. Give it back.”

Taylor:

[3:49] Yeah, it was another popular book about finance.

Becca:

[3:52] But,

But I figure it probably still explains the same concept.

Maggie:

[3:59] It probably does also that book’s more generic than just finance. So I like. Yeah, I like that. Let me know what the 92 other principles are, though, because I haven’t read about those.

Jewels:

[4:10] I did have it on my list to also read that book. But I haven’t yet, so I can’t tell you how different it is.

Maggie:

[4:14] Uh huh. This. Anyway, that wasn’t a complaint that we’re talking about the same book for six podcasts. I just wanted to say that I’m very aware of it.

Becca:

[4:20]

Yeah, it does. It does feel like we’re in a book club that we haven’t invited the listeners to.

Maggie:

[4:29] And then re-listen to the first six podcasts.

Becca:

[4:30] So we’re gonna invite our listeners to read Your Money or Your Life by Vicki Robin and then start over.

Um, cool. And then anything else that you wanted to address of your accomplishments?

Taylor:

[4:45] No, I mean, we could get into the health care stuff because that’s – that was the big accomplishment of last week because Becca had been telling me that I have to have health care.

[4:56] I know. I am the controlling one in the relationship.

Taylor:

[4:56] Whatever. I was just I was just going to keep going without it and just fucking hope for the best.

Um, but yeah, since I’m a freelancer, I don’t get health insurance, even though I’m basically a full time employee.

So I’ve just been kind of like, not.

Last year I had signed up for the Community Care of Austin.

It’s like the local, you know, basically free health care if you’re very, very low income. And I was at the time, I like, I was going through that new program trying to, uh, transition careers.

[5:35] And so I was making basically no money. So I qualified for it. But this year, I don’t qualify for it, since I have a little bit more freelance work going on, and I’m bringing in a little more income.

But I really didn’t want to sign up for health care because that’s like, you know, $300, $400 a month.

That is a lot of money for me at least. Like I think that’s a lot of money, um, to spend on health care.

And I was really stressing about that. And obviously, Becca, you were like, ‘No, you need, you need health care.’

And then Maggie had mentioned how – was it, Mr. Money Mustache? Had written that article about, um, direct primary care, which is kind of like this new movement,

that I didn’t even know about until I read that article where people are basically or doctors are basically trying to offer affordable health care to people that doesn’t include, um, like, catastrophic events.

So if you just want, like, a primary doctor, that’s going to cover 90% of the issues, you’re gonna have, stress-related, you know, the weird rashes, whatever is going on in your life- Looking at you, bitch.

Becca:

[6:43] Don’t look at me so directly.

Taylor:

[6:49] Um, whatever weird body things are going on.

Becca:

[6:54] She points vaguely at my body.

Taylor:

[7:00] Um, yeah, so anyways, I did my research, and there are a handful of doctors in Austin that do direct primary care, and they cover, like so much more than I realized.

Like this was what’s really interesting about direct primary care is they have more of an investment in making sure that you’re healthy.

You’re not just like another cog in the machine, like ‘Okay, get the next patient.’

Maggie:

[7:21] Because your membership fees, they’re always the same.

Taylor:

[7:23] Exactly. Your membership fees are always the same every month. You are paying for their service directly, and they offer things like,

like they’ll do like weight management and like, they’ll help you, like, figure out what works for your lifestyle and like they actually like, there’s like it kind of – Yeah, exactly.

Kind of incorporates like this whole wellness idea and melds it with medicine, which I really like.

So because, like, I feel like every doctor I’ve ever been to, where I’ve been like, hey, like I’ve been gaining weight, I don’t know how to like control that, I don’t know how to function as an adult and they’re just, like, so dismissive, you know, and I feel like very shot down all the time.

It’s like ‘Well just stop eating’ and I’m like, ‘Okay, like that. I’ve tried that.’

I’ve tried that so many times, Um but with this – obviously, like, my first appointment is next Monday.

So, um, with I haven’t tried it out yet, But with this, it seems like they’re much more invested in like you as a person, and, um, it’s much more casual, like they’ll text you If you prefer.

They’ll email you like whatever you want. Um, and you know, you can text them if you have a question, like it just seems really nice.

Maggie:

[8:33] I’m very excited to hear about your experiences with this. And I think I think a lot of people will be very excited to hear about your experiences with this.

Becca:

[8:40] Yes, Well, and it’s a month to month program. So if Taylor realizes that it doesn’t work for her, this doctor doesn’t work for her. She can switch to a different doctor.

Taylor:

[8:49] Yeah, exactly. You can cancel anytime, there’s no penalty or anything.

Maggie:

[8:49] It sounds I’m very optimistic about it.

Taylor:

[8:54] And it’s like, um I am too.

I’m Yeah, I really hope it works out. I and I did a lot of research, and, like the different people that were offering it and honestly came down to like who I thought was the most personable.

Like I looked at all the websites or a lot of websites that were kind of, like, generic and cold and very like, just, like, kind of bad websites. And that really turns me off.

Maggie:

[9:08]

Ooh that’s talking on the whole different issue about good website design.

Taylor:

[9:19] Yeah, it makes a big difference. And like the one that I went with is actually the furthest from me physical distance.

But I loved their website. They had all of these little clips of like, that were relevant to like what was going on in the season, like, ‘Make sure that you’re, you know, doing this. And here’s how to do this,’ like interesting tidbits.

And then I looked at the doctors and I looked at their instagrams too, because I was like, I want to fucking know who you are.

You know, like I’m not paying. No, I’m not gonna say anything political, but I’m not paying no something, supporter.

Maggie:

[9:49] Political statement.

Taylor:

[9:50] Yeah, exactly. Like I don’t want you on. I don’t want you on Instagram, like, you know, railing about your political beliefs.

Jewels:

[9:51] Beep, beep, beep, beep, beep.

Taylor:

[9:58] I just want you to be, like, helpful and friendly and nice. And that’s exactly like the doctor that I picked is like, she’s super hot and, like, that is my only criteria for doctors.

Taylor:

[10:11] But she’s, like, really in a fitness. And but she’s also, like, very kind and has all these videos about, like, super helpful videos online that are like, ‘You do this when you whatever,’ but, um right.

Jewels:

[10:23] But she seemed very genuine and wanting to care for her community, and that that was maybe the reason she gravitated towards direct primary care in her practice and away from the rest of it.

Taylor:

[10:25] She seemed very genuine.

Yeah.

Exactly. Exactly. Yeah. So and I looked up like her credentials and stuff and like where she went to school, and why not? So I made sure she was like a real doctor.

Um, I’m really excited to try it out. And obviously, like all of the websites too, when you look at them, they all recommend that you also carry catastrophic health insurance.

Of course, Um and I was kind of getting in my head a little bit about that, like, ‘Well, what if something really catastrophic does happen?’

Because I really don’t want to go into medical debt, and that makes me nervous.

But, um, I was also – the biggest thing that I’m nervous about that happening.

Like, I don’t have any major health issues right now, and I don’t foresee, like, anything crazy happening where I’m gonna have to, like, go to the emergency room.

Who knows? Maybe I will.

But my biggest worry was that they could take my house away. So I was looking into that, um, but in Texas specifically, and, you know, wherever – you would have to, like, look up because it’s different from state to state.

But in Texas, if you’re a homestead you can’t, they can’t come after you.

My understanding is that they can’t come after you for medical debt, like they can’t foreclose on your home for medical debt.

So we’ll see. Fingers crossed.

Maggie:

[11:45] Yeah, Hopefully that’s one we don’t actually have to find out.

Taylor:

[11:48] Yes, I agree.

Becca:

[11:51] So for for those international listeners that we might have, um, in the US, obviously, you know, our health system is fucked, but, um, that’s obvious. We all know that, um but there’s, ah, this – We are currently in the middle of an open enrollment period, which is the period of time where you can enroll in the government’s healthcare marketplace.

Um, and you can get health care coverage through that if you’re not offered anything through your employer.

Um, so that’s why we’re talking about it now. That’s why it’s particularly relevant in this moment.

Um, and it’s why we all kind of had to make decisions now, um, I guess I’m speaking for myself here. So because my employer does offer insurance, they have an even smaller window.

We had a, like, five or six day window that we had to decide if we wanted to enroll.

I spent a lot of time looking into the direct primary care, as well. And I love it, but I ended up going with my employer’s insurance for a couple reasons.

Um, one. Well, several reasons, I guess, um some more rational than others.

One is that this year is going to be cheaper than through the government marketplace, which is bananas.

Um, so that’s great. I’m actually spending less money in 2020 than in 2019 or no, the other way around. 2021.

I don’t know. I don’t know. Mhm, but it’s less. And I’m just celebrating it. Um, so I’m doing that.

[13:20] Mine’s a catastrophic plan, and my deductible is $1400 less than my government plan is right now. My current plan is a $7900 deductible and out of pocket maximum.

And this new plan is $6500 deductible and the same out of out of pocket maximum.

Um, free virtual doctor visits, which is great.

Um, and it’s HSA eligible, which I learned from Maggie at the first time that we met.

Uh, that gives me an – I hope I don’t butcher this, but it gives me the opportunity to have a non-taxed investment, uh, that I can put in, I think – What do we say? The cap of this year was $3200?

Maggie:

[13:57] I thought it was 31 but then I thought someone corrected me.

Becca:

[14:00] I think it went up this year. It was like, but it’s not much more than that. It’s something.

Jewels:

[14:04] Somewhere in the range of a few $1000 that you can put in an account for retirement if you don’t spend it on health care expenses. It’s not taxed when it goes in, and if you start pulling out during retirement, it’s not tax then either.

Becca:

[14:17] Or if you pull it out for medical expenses, Right? Right.

Um, so I wanted to try that this year. Um, just to see what happens.

Um, yeah. And because I’m hyper paranoid about catastrophic stuff, um, always have been.

So yeah, that’s the reason I went with that option.

And I’m pretty excited. It’s not a fucking HMO – like I I messaged them.

They didn’t have, like, a directory to see if my doctor so the Oh, yeah. The biggest reason is that I wanted my gynecologist and my gynecologist doesn’t offer the direct primary care stuff.

Um, and I love her so much.

Um, so I message this, uh, insurance company. I was like, ‘Hey, is my doctor covered? I can’t find a network,’ and they’re like, ‘Oh, yeah, we cover, we cover all doctors.

Unless they’re, like, refuse to take our money. We take we, we cover everyone,’ which is crazy. That’s like, that’s, like, not a thing. Um.

Taylor:

[15:15] What’s your deductible?

Becca:

[15:17] $6500. I mean, yeah, compared to what I have now, it’s – I would argue it is awful, but it’s not.

Taylor:

[15:19] That’s not bad. I mean.

[15:26] Yeah, I’ve seen the Yeah, the ones on the health.

Becca:

[15:27] Not comparatively speaking, to other catastrophic plans.

Taylor:

[15:31] The healthcare.gov right now are, like, fucking terrible.

Becca:

[15:33] Yeah. Mhm.

Taylor:

[15:36] It’s like $300 for I don’t like $8000 deductible. And, like, doesn’t cover anything. Like, why am I paying this?

Becca:

[15:41] Yeah. Yeah, it’s awful.

And that’s what this plan is. It’s like, no co pays or anything. You pay everything out of pocket until you hit your deductible, but, um, with my with dental coverage, which I always get because my teeth are awful.

Taylor:

[15:48] Yeah.

Becca:

[15:58] Um, I’m really making myself seem very attractive on this podcast.

Taylor:

[16:01] Mhm. Single and ready to mingle, men.

Maggie:

[16:03] Super – coming from the gay member of the group, Becca’s super hot.

Becca:

[16:07] Thanks.

Taylor:

[16:08] Yes. Hey, I can say it too. Actually, I did the other day. I was fixing my sink, and Becca walked in, like, half naked.

You don’t want to make you sound like a trollop, but she was wearing, like, a sports bra. And, like, what else were you wearing? Like shorts?

Becca:

[16:18]

Underwear?

Taylor:

[16:24] Like underwear, I think. And I was like, ‘Damn girl, you looked fine.’

Becca:

[16:30] Thank you. It felt good, because in the moment I felt very awful.

Taylor:

[16:34] Yeah, all yeah, I feel like I was channeling the like, like I don’t like, masculine energy of a plumber.

Becca:

[16:35] It was really nice to hear. Y’all can always tell me I’m hot at any point in time.

Taylor:

[16:46] I was, like, under the sink, like working. And I was like, ‘Damn!’

Jewels:

[16:52] Uh huh. Just something about turning wrenches.

Becca:

[16:56] Yeah, There’s something about it. Ah.

Jewels:

[16:58] What we’re hearing is that you invest in your beautiful smile.

Becca:

[17:03] I invest in this smile. I’ve got a lot of gold crowns in the back of my face.

Um, and I gotta have a budget for it. So but – Oh, yeah, all that to say, my healthcare coverage and dental this year is going to come out to $290 a month, which currently I’m paying, like, $325 a month or something. So I’m making – I’m saving a little bit of money.

Um, but I mean, I’m so excited to see your experience with direct primary care.

Um, because it feels like the future for American healthcare because we’re so fucked, like our system is so awful.

It’s cool that there’s even – like I had no idea this existed until last week. It’s cool that there’s even a new avenue you can explore.

Taylor:

[17:43] Mhm. Yeah, it is nice. Um, and it’s really affordable. I think I pay, like $87 a month.

And then I also decided to get a dental – kind of some –

It’s like kind of like the dental version of direct primary care, where it’s just you pay like $75 a year and anyone who participates, you can go to them.

It’s really like, you know, places like Castle Dental. It’s like not fancy dental places, but it covers X-rays and a teeth cleaning and like it reduces your prices for basic services like fillings and things like that.

So it’s like $40 a filling versus, like, $100 or $200 normally.

So I got that as well. I think it’s called like One Smile or something, you know, like 75 bucks a year, and it covers like basic shit. Teeth are important, and I definitely need it.

Becca:

[18:32] Aw.

Maggie:

[18:36] Yeah, that’s good to have. Teeth are important.

Taylor:

[18:40] So we’ll see. I am nervous about the catastrophic stuff. I do think I probably should have real insurance, but.

Jewels:

[18:47] I would say you’ve made a big upgrade over the last year of not having that catastrophic insurance. And now at least having someone taking care of your general health needs.

Can we talk for a moment about how ridiculous it is that we can only sign up for health insurance once a year?

Maggie:

[19:06] Yeah.

Jewels:

[19:06] Like that makes no sense for men or women, but especially not for women, because that means that if you think you might be planning to start a family, you need to know what type of health insurance, you’re gonna need, like one time a year you have to make that decision. Like next year, am I going to need that type of health insurance? I don’t know.

I’m not planning to have kids, so I’m very thankful I don’t have to think about that every year.

But like picking health insurance is stressful enough without also trying to predict your future, predict your relationships, predict whether or not maybe you end up pregnant at a time you weren’t intending to.

Maggie:

[19:44] Well, yeah, and even if not even a pregnancy, but say like something happens to you and you get diagnosed with cancer or something, you’re stuck with the insurance.

Jewels:

[19:50] Right.

Maggie:

[19:51] You have until you could re enroll. And maybe you have a super high deductible and you’re just like, ‘Well, fuck, guess I’m paying that until next year when I can figure out something different.’

Jewels:

[19:58] Right. There are – off the top of my head, I can’t think of any other insurance industry that runs on an annual cycle like that.

Jewels:

[20:09] If I wanna change my house insurance, I can do that. If I wanna change my car insurance, I can do that.

Jewels:

[20:16] Ridiculous.

Becca:

[20:18] It’s all fucking bullshit. Yes.

Maggie:

[20:19] In general, I’m sort of anti insurance, but I do find that health insurance is necessary, at least in my scenario.

Becca:

[20:28] And so what? What is your health insurance situation, Maggie?

Maggie:

[20:32] So I am offered health – a health insurance plan through my corporate America job, and I sort of, the way I look at it is I don’t even really think about how much it costs.

I just I’m like, I pay that, and that’s what I pay. And I do the high deductible HSA plan because I wanna have an HSA.

But, uh, my health expenses were kind of high this year, just for various reasons, so I might reconsider switching to the low deductible plan, but then I would not be HSA eligible,

but basically I don’t even know how much it costs.

I just like, it comes out of my paycheck and I don’t even think about it because that’s something I have to pay.

Becca:

[21:10] Mm hmm. Mhm. Okay, so you don’t know. Have you looked at like.

Maggie:

[21:11] And I will always pay it so.

[21:17] I could find out. I think it’s probably I probably pay, like close to 200 or more, $200 to $250 per paycheck for my health insurance.

Taylor:

[21:30] It, it seem, it’s probably good health insurance, too. Yeah, that’s not bad.

Maggie:

[21:31] Mhm, yeah, it’s pretty good health insurance. It’s a PPO and I’m HSA eligible, which is high deductible. Quote unquote. I think my deductible’s, my high deductible’s, like $3000.

Taylor:

[21:42] What? That’s amazing.

Maggie:

[21:45] Um, for – but that’s like the. It’s PPO so it’s like pretty much everyone, but that’s in network and everyone I’ve gone to has been in network, then out of network deductible’s more than that – it’s like $7000.

But so far I haven’t had a doctor that wasn’t in – couldn’t find a doctor that hasn’t been in the network yet. So, yeah, and then my co pays are pretty low.

It’s like $20 a visit, and I can see any specialist without a recommendation.

Becca:

[22:11] Oh, my gosh. That’s beautiful. Yeah.

Maggie:

[22:12] So it’s good health insurance. I pay a lot of money for it, but I don’t think about it too hard.

Becca:

[22:17] Nice. Yeah.

Taylor:

[22:18] It just – what drives me. What drives me crazy?

What’s insane to me is that your value as a human is tied to your employment in this country. Like you, like the quality of your health insurance or whether you get health insurance is pretty much tied to, like whether you have a job.

Jewels:

[22:39] Or your spouse, so it’s tied into employment or marriage.

Taylor:

[22:40] Or your spouse. Unless you you are so financially independent that you can afford really expensive healthcare like it just blows my mind.

Taylor:

[22:50] That that’s how we value people in our society is is just completely based around what job they have. It’s kind of sad.

Jewels:

[22:58] Well, there’s definitely been, I feel like in, this country and in many countries, insurance as an idea isn’t really what,

our system is because true insurance should be for only those catastrophic things that really would ruin you. And something more like the direct primary care relationship with a doctor, makes a lot more sense for your ongoing stuff. But with the way that insurance is run in this country, and in many countries, we’ve tied preventative care and ongoing wellness in with insurance, which should only be catastrophic, which has driven insurance costs up without actually giving us the benefit that you get with something like direct primary care.

So if we could have that movement grow a lot more and have insurance return to truly being insurance, which is something you never plan to use. Like right now we’re all trying to find insurance that also covers these expenses we have annually, but really it should be the type of thing that you pay for it. you forget about it, and you hope you never, ever, ever have to use it.

Taylor:

[23:57] Yeah, agreed.

Maggie:

[24:00] I am down with all the that you said Julie. I’m for it. Yeah.

Becca:

[24:03] 100% Just because I want to support the direct primary care movement so much, I was thinking I might still sign up for, like, a really cheap one because some of them are crazy fucking cheap, like $20 a month.

I might sign up for one, just so I have, like, in addition to my insurance, just so that I have, like a doctor I can develop a relationship with which I’ve never done with a primary care doctor.

They’ve exclusively been awful so far in my life experience. Which is why I go to my gynecologist for anything.

Jewels:

[24:33] Yeah. ‘So I have an ear ache’

Becca:

[24:35] Yeah, I went to her. Yeah, I had eczema and I was like, I was like, schedule a well woman and ask her about it, and I did. And she’s perfect. She helped.

Maggie:

[24:45] Okay, So I’m going to correct myself per paycheck for my benefits in general. Not including, like my 401 K and investment.

I pay $238 but includes a lot of things. And, um, my deductible’s not too crazy. Oh, here it is.

Deductible for in network $1750. And for out of network $3500.

Taylor:

[25:11] That is, yeah.

Becca:

[25:12] Very attractive. It’s deeply arousing.

Jewels:

[25:16] That is some sexy insurance.

Maggie:

[25:16] Um, work for giant corporate America and, uh, your health insurance options will improve.

Jewels:

[25:21] Because you are a valuable asset and they want to keep you chugging along for them.

Maggie:

[25:31] Um, I actually have this printed out, though with my boss’s phone number on it in case something happens to me and my girlfriend can easily find it,

figure out what I’m covered for and call my boss and tell her that I’m dying.

Becca:

[25:43] Isn’t that? I had – I, like was talking about how we all need tattoos on our wrists saying which hospitals you can take us, too, if we pass out.

Taylor:

[25:45] That’s so responsible.

Becca:

[25:54] Because again, for the non Americans that might be listening, we – not all hospitals are in your network. So if you feel like you need to go to the hospital, you have to google it and find out what hospitals are covered. Or else you might –

Someone, a good Samaritan, might call an ambulance, which might not be covered. And they might pick you up and take you to a hospital that might not be in your network.

Um, and then you’ve got a $50,000 bill to pay because they took you unconscious to a hospital that wasn’t in your network.

Taylor:

[26:26] Yeah, that is that is real life – you have to decide.

Becca:

[26:26] It’s so fucked up. Mhm. Um.

Maggie:

[26:28] Some hospitals, not all but some hospitals. If they – if you show up there and you’re not in critical condition or after they’ve helped you, will transfer you to a hospital they know is in your network. I would say that’s probably pretty rare, though.

Becca:

[26:37] Mhm.

[26:43] I had a I say friend, but an acquaintance years ago. Well, not many years ago. A couple years ago, who went into diabetic shock?

She passed out, um, and she got someone – a good samaritan called an ambulance and took her to a hospital while she was unconscious.

And it wasn’t in her network. And she left the hospital. I think she was admitted for two days or something. She left the hospital with a $50,000 bill.

And she’s, you know, she worked at a food truck. That was her job.

Taylor:

[27:13] That’s crazy, because at that point, you’re not consenting to that.

So how can they charge you if you didn’t even consent to being sent to the hospital?

Becca:

[27:22] It wasn’t in network.

Taylor:

[27:24] This is crazy like, yeah, it’s – you basically have to decide, ‘Are my injuries life threatening enough for me to want to go into medical debt over this situation?’ Like that is what we deal with with events like this.

Taylor:

[27:38] And like with epilepsy, you know, um, Joey, my partner has epilepsy, and he talks all the time about like, if I have an epileptic seizure, do not call the ambulance unless,

Unless it’s, like, goes on for more than a few minutes where it is critical, like,

a lot of people that have epilepsy, like, insist that you do not call the ambulance because it will cost them thousands of dollars and they’ll be fine, like it’s not right.

Jewels:

[28:04] Just throw me in the trunk and take me to the hospital if you really must.

Taylor:

[28:06]

Just roll him onto the – Yeah, it is. And that’s what. Because if you’ve ever seen anyone having a seizure, which I know Becca has, it is fucking terrifying, like they look like they’re dying.

Maggie:

[28:11] Fine, fine is such a relative term in that in that scenario.

Taylor:

[28:24] They go like gray, and they just like – it’s fucking terrifying and so. Exactly. And like, your first instinct is like to call for help.

Maggie:

[28:25] Especially to see someone you love like in that.

Taylor:

[28:34] So, um but yeah, In America we have to weigh our options when it comes to getting help the help we need versus if we want to pay catastrophic amounts of money for it.

So that’s fun.

Jewels:

[28:49] I have done everything in my power to avoid going to a hospital on many occasions.

Taylor:

[28:53] She – you really have, including being bitten by a poisonous snake.

Jewels:

[28:56] Okay, I’m alive.

Taylor:

[29:00] Yeah.

Maggie:

[29:02] Venomous snake.

Jewels:

[29:04] Venomous. Yes.

Taylor:

[29:05] What’s the difference?

Maggie:

[29:06] Poison is something you ingest. And venom is something that is put in you.

Taylor:

[29:09] Really?

Taylor:

[29:13] I never knew that. You learn something new everyday, kids.

Maggie:

[29:17] So unless Julie ate the snake.

Jewels:

[29:20] From my memory. No, I do not believe I do not believe I did.

Taylor:

[29:21] That is interesting. I didn’t realize it had, like, a a tie to like, whether you ingested it or if it was put in.

Becca:

[29:28] Mhm.

Jewels:

[29:29] Uh huh.

Taylor:

[29:29] Yeah.

Becca:

[29:32] Ah, Julie, what’s your health insurance situation?

Jewels:

[29:35] I really wish I knew more about it to be able to describe it.

Um, I asked Zach, but because he – we we made all these decisions a year or so ago, and we’ve decided to stick with the same insurance that we currently have.

So it’s not fresh in either of our minds, but it is not from the marketplace. It is not direct primary care.

It is, I think, more one of the health insurance pools, but not one of the religious ones.

Becca:

[30:04] Not one of the Christian co-ops. I tried to get into it, and you gotta be really religious.

Jewels:

[30:05] No, I don’t believe so. They would have.

Yeah, they would have filtered me out pretty fast. Um, so yeah, yeah, yeah.

Becca:

[30:14] Hi. Have you tried to pray it away? Because we actually can’t admit you until you’ve tried.

Taylor:

[30:21] God will heal you.

Jewels:

[30:23] Uh huh.

But having actually, for the first time in 10 years, gone to a primary care physician for an annual checkup and then gone back to get drugs for a kidney stone.

Becca:

[30:33] Oh, shit.

Jewels:

[30:38] And I’m really starting to sort of build a relationship with a direct primary or not direct primary care.

A primary care doctor who I love.

I’ve avoided doctors for so long because I’ve always felt like they, um, were really just acting as a cog in the system or didn’t care about me as a human. Or, especially as women,

I often find that doctors don’t take us seriously or don’t believe us when we tell them what’s going on.

And I have a very high pain tolerance.

I’ve had a lot of injuries and traumatic things happen so I can walk in to a doctor and tell them what’s going on in excruciating pain,

without them, without looking like what you would expect someone in the level of pain that I’m in in that moment and so they don’t take you seriously.

So I have always taken, in the few instances where I’ve actually gone,

I’ve always taken an advocate with me. Maggie has been that for me before, and my husband, because they will stand there, be like no, really, she’s in pain like she doesn’t.

Maggie:

[31:41] She doesn’t look like it, but but if she’s in this room, she’s in pain.

Jewels:

[31:44] Yeah, yeah, the fact that she’s here is all you need to know.

Um, so, having actually, like I researched, and I talked to other women here in Austin and found out which practices they liked.

And then I picked a doctor, one of them. And my husband and I decided both go to the same doctor so that we could have back to back appointments, so we’d both be in the room at the same time all the time. So I always have an advocate there, and I don’t even need that anymore.

After the first appointment with our current doctor, I was, like in love.

Becca:

[32:19] That’s amazing. That’s amazing.

Jewels:

[32:20] Okay, Mhm. And the fact that the practice we picked has a really strong focus on wellness, and actual, like care for you and not just reactive medicine,

which is one of the reasons we picked them, so.

Taylor:

[32:37] That’s awesome. Can you remind me again what you signed up for? Like what the plan is?

Jewels:

[32:42] I don’t I don’t know what it is I can find out.

But my point in talking about the doctor relationship is that this is the first year I’ve ever actually, in a long time, like, submitted something to insurance and, you know, gone through that process, having done sort of our basic care.

And I think we have, um it’s like they – I want to say they cover, like they do 80% and we do the 20% co pay or something like that.

Our monthly – and I could be totally wrong on that.

I could not believe, um I could not believe going like when I had to get, um, the painkillers for the kidney stone.

And I was, you know, dreading having to go to the pharmacy and pick it up to find out what it was going to cost.

I’m constantly on like goodrx.com, trying to find coupons for things because, um,

I used to take a prescription for rosacea that was, oh, I can’t remember what it’s called.

Um, but without insurance for a 30 day supply of something you were supposed to take every day, they wanted to charge me at different points between $200-$400,

for something that the base pharmaceutical in it is –

Maggie:

[34:08] I don’t remember. It was like a – It’s like an antibiotic, though, right? Yeah, it’s an antibiotic.

Jewels:

[34:08] It’s your standard antibiotic. Yeah, I’ve said it so many times in my life, I should know. Doxycycline!

Becca:

[34:16] Oh that was it?

Jewels:

[34:18] That that was it. The particular prescription that skyrocketed in price, like from one month to the next, was a particular formulation of it.

Yeah, I buy it. So then, when Maggie and I are traveling overseas, I go and raid all the pharmacies there, and it costs me like, 10 bucks for a year supply.

Or when when the prices jumped here, to that, I started ordering it from India because I could buy a year supply or, like three years supply for, like, $70.

Becca:

[34:46] That’s a sweet little health hack.

Taylor:

[34:48] Is it safe to buy medicine online? Because I looked into that and I didn’t. There was some websites that were like, ‘Don’t do it.’ I was like, ‘But it’s so cheap.’

Jewels:

[34:55] I can absolutely not make a statement on that for this particular very, very –

Maggie:

[35:01] And I feel the need that I have to make a statement on that, which is, like, maybe be careful. Just be careful.

Taylor:

[35:05] Yeah, I’m going to do it.

Jewels:

[35:10] Um, in this instance, I was comfortable with testing the waters to see if it was legitimate and if it would show up on my door because this is literally one of the most common antibiotics globally.

Jewels:

[35:22] It’s taken as an anti malarial when you travel. You can find it in any pharmacy. In most countries, you don’t need a prescription. You just buy it over the counter.

Taylor:

[35:26] Right, it’s not like a lifesaving kind of.

Jewels:

[35:30] So for something like that, I was willing to take the risk. Right.

But when I went to get the medications for my kidney stone and he was like, ‘Oh, no, it’s $10 and actually going to be cheaper with your insurance than with the GoodRx coupon blah, blah, blah.’

And that blew my mind because my experience has been so different leading up to this point.

Um so yeah, I’ve been very happy with it. So we’ve decided to just stick with that for now and focus on other things this month because it’s such a drain every year to have to weigh all your options, see the current state of things, watch the prices of the health care. um, the marketplace plans just go up and up and up every year.

Taylor:

[36:13] I I do wanna know when you find out what your insurance is because I am curious because I know you’re also a freelancer. It would be. Are – you own your own business so it would be interesting to know what, how, the route that you took.

Jewels:

[36:20] Mhm. And I do know the monthly cost. That is, I think about 450 a month. And that covers both of us.

Becca:

[36:33] Wow, that’s wonderful.

Taylor:

[36:33] See, that’s amazing. For both of you. That’s a really good -that seems like a really reasonable price.

Jewels:

[36:34] Uh huh.

Yeah.

And it’s, it’s definitely not a low deductible, like it’s a high deductible, but because it also has some of the copay along the way.

For normal, non catastrophic stuff, the chances of us hitting the co pay is – or the deductible.

Maggie:

[36:52] I was going to bring up that I feel like I had a very stunted growth in this adulting aspect of my life because I could always just call my mom and be like ‘Mom.

I have I have this. What? Is it something to worry about? Am I dying?’

And then she’ll be like, yes or no.

Or then she’d be like ‘I have a friend who’s, uh, you know, a dentist and go see them and they’ll take care of you.’

Or, you know, I just always had, like, a hook up, so to speak. And not to say that I didn’t pay, like, co pays and like, have health insurance. But I always just, like, kind of relied on my mom to tell me what to do for so long.

And it took me a really long time to, like, figure out that maybe I should separate my mom from my personal health issues.

Jewels:

[37:38] What was the.

Maggie:

[37:39] I think I think it was at some point in college where I was just like I I just I think I had something I needed to go to the UT Health Center for, and I was just like.

No, I really need to see someone in person rather than call my mom about this. I can’t remember what it was.

Uh, no, I think it was when I was I was I think it was when I figured out that – when I wasn’t having periods for so long at a time and I called my mom about it, and she was like, ‘You should definitely see someone about that.’

I was like, ‘Oh, I okay, well, you you’re a gynecologist. You’re just not going to tell me what to do?’ And she’s like, ‘No, I think you should see someone about that.’

I was like, ‘Oh, I guess I will then.’ And I went to the UT Health and Center or whatever, and they helped me out.

And after that, I was like, I’m an adult. I could have been doing this for ages and like, take charge of my own health and see my own doctors when I want to.

Becca:

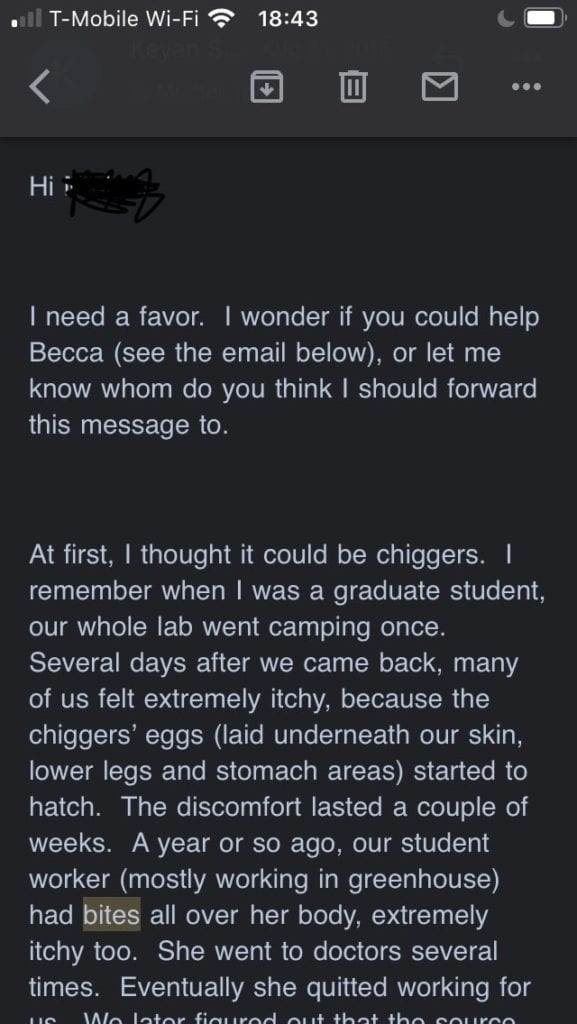

[38:32] I once had a doctor. There’s, I won’t tell this whole story because it’s insane. But I thought I had ghost spiders living in my skin.

Uh, ghost spiders living in my skin.

Jewels:

[38:40] I’m sorry. Ghost spiders?

Becca:

[38:44] I kept getting spider bites only on my right side between my knee and my ankle.

It only happened at night. It was the weirdest fucking thing in the world.

I’d wake up and there was a new fucking spider bite. And I treated my whole apartment for bedbugs. I replaced my mattress. I didn’t sleep for ages because I’d wake up and be like, ‘I feel you, motherfucker!’ And I would like, shine a light and there’s nothing there.

Taylor:

[38:58] No, My God!

Becca:

[39:06] And I even read, read this forum where this woman like, took a bath in olive oil, and then all these, like spiders crawled out of her skin.

Maggie:

[39:14] No. Uh huh.

Becca:

[39:14] It was probably fake, but I did it.

Maggie:

[39:19] Nobody liked that. Nobody liked hearing about that.

Becca:

[39:20] No.

Yeah, and nothing crawled out of my skin. So like at this point, I’d lost my mind.

Taylor:

[39:26] That’s an expensive bath. That’s like 100 bottles of olive oil.

Becca:

[39:28] Yeah, well, it wasn’t totally olive oil. It was like partial olive oil. I’m not made of money.

Taylor:

[39:34] That would be, like $500 worth of olive oil.

Maggie:

[39:36] Oh, wait, this is – So how much money is $500? Bottles of olive oil. Taylor’s guess: $500.

Taylor:

[39:46] Huh? No. Okay. Okay.

Maggie:

[39:49] So I’m going to guess. I’m gonna guess a different amount.

Taylor:

[39:53] No. Okay. If you had to fill a bathtub full of just olive oil, Okay. Olive oil.

Jewels:

[39:58] Are we? Are we using your Sam’s Club membership?

Taylor:

[40:00] Okay. Say, we’re just going to like HEB or normal grocery store. Okay.

Taylor:

[40:05] Ah, Bottle of olive oil, right is like $7 to $10. I’m guessing you would probably have to fill that bathtub with, like, at least ah, 100 bottles.

Becca:

[40:17] Oh, I bet it’s not 100.

Jewels:

[40:18] Way too many.

Taylor:

[40:19] So, like, 700. I know. I’m realizing that now.

Maggie:

[40:19] Math wise, you’re off.

Taylor:

[40:25] So that’s like $1000 worth of olive oil.

Becca:

[40:29] Okay. I didn’t spend $1000 on olive oil. It was a partial olive oil bath. Anyways, nothing called out of my skin.

Becca:

[40:38] And so finally I I emailed. Actually, y’all will appreciate – this the two bug enthusiasts among us.

Taylor:

[40:46] Listen. Ghost Spiders are sacred, Becca.

Becca:

[40:51] I emailed every entomologist in Texas.

Becca:

[40:55] I’m emailed them a picture unsolicited. Yeah, this is 100% true.

[41:06] Every entomologist that I could find that was a professor level or higher.

Becca:

[41:12] And I emailed them a picture of my spider bites nd I was like, ‘Please tell me what this is.’

Taylor:

[41:21] Oh my god, I’m dying.

Becca:

[41:23] Yeah.

Jewels:

[41:23] Yeah. Did you get any responses?

Becca:

[41:27] Two – I don’t remember what one of them was, but one of them said you should probably just go to your doctor.

Becca:

[41:34] And I had written that off as an idea. I was like, “Go to a doctor? What’s a doctor going to do about fucking nighttime spider bites?”

Taylor:

[41:34] Oh, my God.

Taylor:

[41:43] Ghost. Spiders. Oh, my God.

Jewels:

[41:45] But the entomologist is definitely going to know what to do about nighttime spider bites.

Becca:

[41:46] Right.

Um, and like, a couple of people – oh, a couple –

One person she, she. One person responded that I should put scotch tape on a cut, on a bite and rip it off and see if, like a stinger or something came out. There was a couple buggy responses.

So I go to the doctor by the entomologist’s request.

Taylor:

[42:18] I can’t breathe.

Becca:

[42:18]

And I was like, I like had I hadn’t slept.

I was like I looked gaunt and awful, And I was like, I was literally sitting on the table hugging my knees into my chest because at this point, I had so many spider bites all over my leg and they were just. They were huge and hot and awful, like they felt hyper infected.

And I was just like, losing my mind. And the nurse comes in and she was like, ‘Oh, it looks like you have folliculitis.’ And I was like “What?” and she’s like, ‘Yeah, you just have inflammation of your hair follicles.’

And I was like, ‘Are you serious?’ And I like flashback to the last five weeks of me like-

Maggie:

[43:01] Emailing entomologists about ghost spiders.

Jewels:

[43:03] About ghosts, spiders, performing an exorcism.

Becca:

[43:03] And like, poison, Yeah.

Taylor:

[43:05] Burning your mattress, bathing in olive oil.

Maggie:

[43:10] Yeah, I really wish. I really wish you would have called me around this time, cause I was probably taking Entomology, and I would have gone up to my professor. And I’m like, did you get an email? I know that person.

Becca:

[43:24] Well, he did. I’m telling you right now they got the email.

Um, yeah. And then sure enough, that’s what I had. But that wasn’t the point of this story.

So I had folliculitis, which is, like, the most basic skin infection you can have.

Um and apparently I was getting it from shaving. And that’s why it was showing up at night.

Because I take night showers. I would shave and it would spread it up my leg and then I fall asleep and I’d get a new infection in a hair follicle. Really weird.

But one was really bad. And so he tested it for MRSA.

I didn’t know what MRSA was, but he was like, ‘This actually looks pretty bad. I’m going to test this for MRSA.’ And then he looks at me winks and said, ‘There’s an NFL player in the hospital for this right now,’ as if that was going to make me feel better.

Maggie:

[44:11] Not. Yeah, no.

Jewels:

[44:14] Right. Hello, bedside manner.

Becca:

[44:15] And so I was like, Okay, he was awful.

And so I like, leave the office and call my mom because I call my mom all the time with my health stuff, usually after I know what was happening.

But at this point, I’d lost my mind. And so I told her I was like, ‘Okay, it wasn’t ghost spiders, but I got, but I got tested for MRSA’ and she freaked out in my mom’s nature, which is not very dramatic, but by her standards she was like ‘MRSA? Like that – you need to be in. If you have MRSA, you like have to be in the hospital. It’s crazy, crazy, contagious and it’s awful.’

And I was like, ‘I don’t know, he didn’t seem too concerned.’

He winked at me and so he tested me for MRSA and I just never heard back. This is looping back to your –like they just didn’t call me.

Jewels:

[44:56] Oh, it’s.

Maggie:

[44:58] I’m glad you’re OK.

Becca:

[44:59] And so I called them. After I learned what MRSA was, I called them and I was like, ‘Can you just tell me if I have it, please?’ and they’re like, “Mmm, the doctor is not in right now. We can’t really share that information.’ I was like, ‘Please,’ yeah, I was taking – Sorry, this is a very long story.

Jewels:

[45:11] But it’s my information. Yes.

Becca:

[45:17] He had prescribed me an antibiotic and I took it and I was allergic to it.

Becca:

[45:21] So my whole body had breaken out in like a hot rash. Yeah, it was awful.

Becca:

[45:26] And so I, after learning what MRSA was, was convinced I had a blood infection and I was dying.

Becca:

[45:33] So I called that, I called them and was like, ‘Please just tell me if I have MRSA because my body is hot, I’m covered in a rash.’

Becca:

[45:42] ‘I’m worried I’m dying’ and they’re like, ‘We can’t really tell you, but we do need to encourage you to continue taking your antibiotic.’

Jewels:

[45:47] You know.

Becca:

[45:50] And i was like “I can’t sleep”

Maggie:

[45:53] Yeah. Also, that person potentially could get fired. Yeah, Fuck that person. You’re literally describing allergic reaction to a person who is then telling you.

Becca:

[45:57] Oh, well, then.

Jewels:

[45:58] Yeah. You’re literally having an allergic reaction.

Becca:

[46:03] It sounds like it was a textbook reaction as well. Like that’s like what happens. Yeah.

Jewels:

[46:07] Oh, yeah, Yeah, I’m allergic to penicillin. And it’s the same. Any of the like, Penicillin derived antibiotics just instant, like major rash.

Becca:

[46:17] Awful. Yeah.

Jewels:

[46:18] Mhm. Mhm. But keep taking that thing that your body clearly doesn’t like.

Taylor:

[46:24] Ghost Spiders is the funniest thing I’ve ever heard in my life.

Jewels:

[46:28] Uh huh. This was a roller coaster. I’m so sorry you went through that. We’re finding it hilarious now, but at the time, that must have been terrible.

Becca:

[46:30]

It’s objectively funny now.

Jewels:

[46:39] Uh huh. We all feel better about our bodies. Now, I do find it very interesting that we all have taken a slightly different path to our health insurance this year.

Jewels:

[46:53] Like, really quite some of us. Quite different. That’s I’ll be very interested here.

Becca:

[46:55] Yeah.

Maggie:

[46:58] Report back at the end of 2021. See who’s paid the most for their health?

Becca:

[47:00] Seriously, we seriously should. That’d be really fascinating when/

Jewels:

[47:02] Vaginance, now hosted by the one remaining member who’s still alive.

Taylor:

[47:10] The one with real health insurance.

Maggie:

[47:10] The other three are homeless.

Becca:

[47:15] Cool Yeah, that was, I really enjoyed this episode.

Maggie:

[47:15] Yeah.

Taylor:

[47:18] I don’t think I’ve laughed that hard in such a long time.

Maggie:

[47:21] Your laugh was, Y=yeah. Exponential laugh levels for sure.