Becca:

[0:02] Welcome to Vaginance, we’re very happy to be here.

Taylor:

[0:06] It’s weird to think about having a retirement account at all because you’re basically like, you’re investing in your future. Like I’m going to be alive at 50 and need this money.

Jewels:

[0:18] Are you struggling with this right now?

Maggie:

[0:20] Yeah, well, see, you’re talking to ‘Who’s-going-to-die-any-minute-now-Maggie’, and I invested my 401K so that I can eventually convert it into a Roth IRA and pull it out whenever the hell I want.

Taylor:

[0:29] That’s a good point.

Becca:

[0:35] Retirement. So we’re all gambling on the fact that we’ll live to a retirement age, I guess, excluding Maggie. She’s got a conversion thing that she’s worked out.

Taylor:

[0:40] Yeah.

Maggie:

[0:44] Oh, I’m definitely not living to retirement age.

Taylor:

[0:45] I mean, I’m kind of banking on medical advancements rapidly progressing in our lifetime tour.

Becca:

[0:45] Okay.

Taylor:

[0:53] We can just upload our brains to computers, so and that will be really interesting with like accessing our digital money and we’re all digital.

Jewels:

[1:01] And then you’ll need a lot of money for retirement if you’re going to live a lot longer.

Taylor:

[1:04] Yeah.

Maggie:

[1:06] Not if it’s compounding interest the whole time baby!

Taylor:

[1:10] Yeah, here’s my body, do whatever you want.

Maggie:

[1:12] So retirement accounts, it all it all comes together, man.

Becca:

[1:15] Retirement accounts. It really does. Yeah. We’re going to cover some, some retirement accounts that we think that a lot of us and a lot of folks listening either have, or might consider getting, and then we might get into the weeds a little bit after that. Yeah.

Taylor:

[1:20] I have a question. Why should I get a retirement account? Why? Why does it matter? Why have one.

Becca:

[1:35] Yeah. Why?

Jewels:

[1:37] Well, Taylor, that queues it up perfectly for a realization that I had about categories of retirement accounts. Because we’ve been doing and talking about investing on things like Public, but any of the money you’re investing in Public right now, you’ve already had to pay taxes on. So, instead of getting to invest a dollar, you’ve been investing, say 85 cents of that dollar. But one of the categories of retirement accounts are pre-tax accounts, which means you don’t pay taxes on the money you invest until retirement age. So instead of investing 85 cents now, you get to invest the full dollar, and then when you withdraw it in retirement, you pay ordinary income tax on that at that time.

Taylor:

[2:21] Ordinary income tax?

Jewels:

[2:23] Yeah, so whatever your tax rate is then.

Taylor:

[2:21] So if you’re in a much higher tax rate then, you’re paying a lot more than you would know?Jewels:

[2:36] Right, and so the other category of retirement accounts from a tax perspective, are post tax accounts. So, on those ones you pay the taxes now and you invested in your retirement account.

Taylor:

[2:37] Right.

Jewels:

[2:41] And then when you pull it out in retirement, you don’t pay taxes.

Taylor:

[2:43] So why are you paying taxes if you’re pulling it out during retirement? If you’re retired, don’t you technically not have an income?

Jewels:

[2:46] That is income.

Maggie:

[2:52] It counts, that counts as income. But the idea is that you could pull out, so say the lowest tax bracket, or one of the tax brackets like $10,000 – $50,000, you could pull out $49,999 that you don’t jump yourself…

Taylor:

[3:04] Oh… and it taxes you on that amount that you’re pulling out, and it’s like the same as like if you had made 49,000.

Maggie:

[3:10] So right now your tax bracket might be like, 25%, but then when you pull it out you can pull out less money and you don’t have an income also, so you’re actually paying less taxes later on. Unless when you retire you want to be fucking baller, and like pull out a shit ton of money then it’d be…

Taylor:

[3:21] A million dollars, which won’t be that much with inflation when we’re old.

Jewels:

[3:33] Because we are so youthful right now.

Maggie:

[3:33] I just like the body language that was involved with that which our viewers can’t see. But Taylor very casually took a sip of

her drink right after the end of that sentence. It’s hilarious.

Becca:

[3:47] Um, yeah so does that…. I guess starts us off well with talking about Roth I

RA versus traditional IRA. Does that sound good to everybody?

Maggie:

[3:57] I was going to say how about you broaden that to Roth retirement accounts versus traditional retirement accounts.

Taylor:

[4:04] Oh yeah I like that, yeah.

Becca:

[4:06] Yeah. Okay so Roth retirement accounts are the version of retirement accounts in the bucket that Julie was describing earlier, where you’re going to pay taxes when you put the money in versus paying when you take it out, which is traditional. So Roth can be a descriptor for IRAs or for 401Ks, so it can be employer or individually managed, and same with traditional. So, it just depends on what we were just talking about – what’s most strategic for you. Maggie was kind of arguing in the traditional side of saying that if you don’t pay taxes on the way in. on the way out of the account, you could have more control over how much you’re pulling out and therefore could manipulate a little bit more how many taxes you’re paying. Um, and then I think Julie might have been more on the side of Roth, where if you assume that you’re in a lower tax bracket now, you want to pay your taxes now as opposed to when you pull it out.

Jewels:

[5:07] Yeah, so I think I could argue both sides. It really depends on what you think you’re work situation is going to be like between now and retirement age. If you plan to be a more traditional, employee or self employed person, but if you plan to work all the way through retirement and your income is going to be going up over that time, and then your tax liability is going to be going up over that time, then investing in a Roth earlier with your lower tax bracket might be to your advantage. Or splitting your investment over both, a Roth and a traditional gives you tax diversification, which a lot of financial advisors will recommend because what it does is it sort of hedges your bets like, okay, half my money I’m going to pay my current tax rate and half my money I’m going to pay my retirement tax rate and I’m going to kind of split the difference.

Taylor:

[5:57] And you can invest both, like the same right? Like into the stock market or whatever you want to invest it in.

Jewels:

[6:00] Yes, so different accounts and (we’ll kind of get into that) different accounts have different investment options, but in general your traditional versus the Roth, if you just split it over that you’re going to end up with an average of your tax right between now and retirement. But if you plan to retire early, or you plan to take many retirements during working years where you may have low or no income, it is actually much, much better (potentially) to invest in a traditional account where you get to put more money in now because you’re not paying the taxes on it, letting that money compound, and then during your low income year, there are ways to move that into a Roth while you’re in a low tax bracket for that year.

Becca:

[6:40] Mm.

Jewels:

[6:41] It also can free that money up because any money that you contribute and we can… this is a little earlier than we anticipated to do this, but we’ll get into Roth conversion ladder later on, but it also allows you, any money that you contribute to your Roth, the principal you put in, you can withdraw five years later. So you can’t take out any of the money that’s been gained from your investments, but it does free up the principal again. So if you’re going to have lower income years, early retirement years, that frees up a lot of your cash.

Maggie:

[7:12] And that could, that could that has the potential of meaning you pay no taxes at all.

Jewels:

[7:15] Right.

Taylor:

[7:20] How… I don’t… sorry, I don’t understand.

Jewels:

[7:20] Okay. So let’s say you’re in a 25% tax bracket… is that a tax bracket? Let’s say you’re in a 20% tax bracket this year, but you put money in a traditional retirement account, so that means you don’t pay taxes on it this year. And then, let’s say that in five years you take a year off of work, so you’re making no income, you decide to roll that into a Roth. It’s going to get taxed because any time you put money into a Roth it gets taxed at that time. So it’ll get taxed at your tax bracket that year. So depending how much you roll..

Taylor:

[7:54] So you can avoid paying that 20%.

Jewels:

[7:55] Exactly. So you may roll, and you may decide, okay, I’m going to roll up to… things like the 12% tax bracket.

Maggie:

[8:06] I can look up if you want.

Jewels:

[8:07] I think for married people it’s like $75,000 or something.

Maggie:

[8:13] So for 12% for single…. $40,500.

Jewels:

[8:13] So you could roll $40,000 over and have it taxed at the marginal tax rate, the last bit will get taxed at 12%.

Taylor:

[8:29] So I have a rollover IRA right now that I had rolled over some like… I guess it wasn’t, I don’t know if it was a 401K or just like… was with Principal Bank, it was kind of like a 401K from my previous employer. I rolled that over into a rollover IRA account because they wouldn’t let me put it right into my Roth and then they said I could move it into my Roth, but right now I just have it sitting in my rollover account invested in stuff. So would that be, that’s what that is, is like a traditional IRA that I could then roll over into my Roth if I have it in a lower tax bracket.

Jewels:

[9:00] Exactly, exactly. And because you get your standard deductions each year as well, you can actually roll over more than, say, that 44… how much was it??

Maggie:

[9:11] $40,500.

Taylor:

[9:12] Got it.

Jewels:

[9:14] You can actually roll over more because you get a standard deduction that lowers it even more.

Taylor:

[9:17] Mm hmm. Cool. Fuck yeah, fuck taxes.

Jewels:

[9:18] So you’ve actually like got a negative, you can roll up.

Becca:

[9:22] Mhm.

Taylor:

[9:22] So if I have all that money right now invested, I’m assuming and I think we’ve talked about this before, I’m assuming I would have to sell my investments, before moving the money over because it’s all tied up in like, the stock market right now.

Maggie:

[9:38] I think the answer to that is yes, but that’s definitely a ‘call your brokerage and ask’ answer.

Taylor:

[9:39] Yeah, because I don’t want to fuck up again and they like, automatically take out a loan and I’ve got $7,000 sitting there on interest.

Maggie:

[9:49] Yeah, my understanding is when you’re moving accounts, it has to be quote, unquote “in cash”

Taylor:

[9:53] Like liquid cash kind of thing. Okay, cool. Also, so I have never, because I’ve worked mostly freelance, I’ve only had one job for like six months where it was… where I even had a 401K. But I am interested to hear kind of a little bit more how 401Ks work with traditional employment?

because I assume a lot of people, traditionally will have a 401K as opposed to something else. So what’s, what’s up with that?

Maggie:

[10:27] What’s up with a 401K.

Taylor:

[10:28] Yeah. What’s the deal with those? How do you get them?

Maggie:

[10:30] How do you get them?

Taylor:

[10:33] How do you get a real job?

Becca:

[10:34] Now, that’s a much harder question that I have not figured out. Um, but a 401 K… so 401Ks and IRAs are totally different. IRA stands for Individual Retirement Arrangement. So it’s just you figuring it out ,right? And, you know maybe your financial advisor. 401Ks are employer managed. So, the money is contributed by your employer before it even hits your paycheck. Instead they’re diverting it to your 401K. Um, well I guess that’s the traditional 401K. I think Roth IRA or Roth 401K might be different, but I could be wrong.So anyways yeah so employer is diverting that money to your 401K. In my case I think its pre-tax, so it’s traditional for a 401K. And most employers will match your contributions. So, we would encourage, (though we’re not financial advisors) that if you have the opportunity to have a 401K where an employer matches any percentage, at least put that much money in and take advantage of that free money because, for instance, my employer matches 4%. So, while that feels like a small amount or it might sound like a small amount, that’s a 4% increase in my salary because I put in 10% of my 401K and they match up to 4% of that. So 14% of what I make every month can go directly to my 401K. So yeah, definitely take advantage of it if you have the opportunity, even if it seems like a lot of paperwork, it’s really not that much, it’s really worth your time. Take an afternoon, talk to your boss and set it up if you haven’t already and you have the opportunity to.

Maggie:

[12:18] Yeah, I have to second Becca. I know a lot of people in our peer groups that have not been taking advantage of their 401Ks for years and have had the opportunity to and that’s so much… so much lost money.

Taylor:

[12:32] It’s literally throwing money away.

Maggie:

[12:34] Yeah and if you’re, like Becca said to, if you don’t want to contribute to your 401K, that’s fine, but at least take the free money part of it.

Taylor:

[12:39] Totally. So what do you… when you say match? Do you have to like, every paycheck, every time you get paid – do you have to physically go into your bank account and put in money into your 401K.

Becca:

[12:50] They’ll do it.

Taylor:

[12:51] They’ll do it for you. So, you how do you like click it? To be like, ‘match, put all the…’

Becca:

[13:00] So they’ll have it set up through a company, in my case it’s Human Interest, but there’s plenty of different companies that a company will work through, and they’ll set you up with an account or they’ll tell you to set up an account with that company. There’s probably going to be an email with that information go into that account. It’s usually super easy. You go in, you click what percentage you want to contribute. Your employer will have told you what percentage they’ll match, so click up to that number and if you have the means, click up higher. But yeah, and then it’s automatic from then on, you don’t have to do shit, and it’s managed.

Maggie:

[13:29] Kind of like what she said earlier, it’s almost like a direct deposit like before you even see the money it’s already been separated out. Yeah.

Taylor:

[13:34] Right, you don’t even have to think about it, that’s really nice.

Jewels:

[13:36] It’s just like your tax withholding, like when you get a pay stub and it’s like, oh it’s withheld these taxes and these Medicare and FICA and all of that. It’ll have your retirement withholdings as well.

Maggie:

[13:47] Another really good reason to contribute to your 401K if your company offers one – you could potentially put yourself in a lower tax bracket by contributing an amount to your 401K. So if you’re like on the edge of a tax bracket like that 12% we were talking about, $40,500 and you contribute even $1000 to your 401K it’ll bump you lower into a lower tax bracket.

Becca:

[14:11] Oh that’s fucking cool.

Taylor:

[14:12] Interesting.

Maggie:

[14:13] That’s why… I mean I max out… I don’t max out but I intend to at some point once I get my finances sorted, max out my 401K, max out my HSCEI, like do all of the retirement accounts because then you’re also on all of the money you’re not contributing, in a lower tax bracket too.

Taylor:

[14:31] Oh that’s cool.

Jewels:

[14:33] Any money you move into a traditional retirement account lowers your taxable income for the year.

Taylor:

[14:35] Oh that’s why whenever you do your taxes every year and it asks you how much you put into your Roth IRA, it will like lower what you owe, right?

Jewels:

[14:46] Not for the Roth though because you pay taxes on the Roth now. But for your other retirement accounts, which will also be.. like you also fill that out in your taxes and that will lower it.

Taylor:

[14:52] Oh okay. Because I always remember when you go through, like the tax, whatever it is, what is it?

Becca:

[15:05] When you file your taxes?

Taylor:

[15:06] Yeah. What’s the one that everyone does? TurboTax. TurboTax asks you how much you’ve put into your certain accounts like IRA… It asks for IRA and Roth IRA and then it will like, you can see how much you’re getting back will change based off how much you put in those accounts.

Becca:

[15:25] Yeah.

Jewels:

[15:26] Exactly.

Becca:

[15:28] I just have a question. So, I saw that you can contribute to your Roth IRA and I think traditional IRA but I could be wrong, but I know you can contribute to your Roth IRA up until the tax deadline of the next year. So if I were to contribute today to my Roth IRA, that would be for my 2020 taxable year. Would y’all say – considering when this podcast is being recorded and possibly released right before the tax deadline – unless it’s been extended entirely right?

Jewels:

[16:01] It has. So, for for non self-employed people it’s been bumped out until I think at least mid May.

Taylor:

[16:09] What about self-employed people?

Jewels:

[16:11] Well, the business often is the contributor then. So, it depends on what type of retirement account you have.

Becca:

[16:19] Yeah. Would it be advantageous for people to act now if they don’t have a Roth IRA, but they want to set one up – would it be advantageous for them to put in their max or whatever they have available now before the end of the 2020 taxable year? Or should they wait?

Jewels:

[16:44] The one thing I don’t know is whether the account had to have been set up during the year you’re during your taxes.

Becca:

[16:45] It didn’t.

Jewels:

[16:46] Okay perfect. Then in that case, it would be a great idea to pull up a tax calculator, put your income in, do all your other major deductions and stuff and then play with the retirement account lines to see like, ‘oh if I move, 5000 into there maybe it saves me 500 on my taxes, purely speculative numbers. That’s not true at all. But it will be something like that.

Taylor:

[17:16] And you can literally… you can do that on TurboTax. Like if you literally just put in a fake number like… Oh I put in 2000 into my IRA, it will show you, the number will go up on how much you get back, so you can literally see it in real time how much you’ll get back by just putting in a number.

Jewels:

[17:30] So if you have spare cash in the account that you’re prepared to invest for retirement, it would be a great idea to go in there and sort of tweak your taxes from last year.

Taylor:

[17:35] And I know, oh sorry, I was just going to say, I know that when you put in money to your IRA, it asks you which year you want it to be for. So like it will say ‘do you want this to count towards your 2020 year or your 2021 year?’ I don’t really know, I never know how to answer that, but…

Maggie:

[18:03] I was just gonna say, also keep in mind that you can… the max contribution for I think a single person is $6000 into an IRA. But if you’re rolling over a different retirement account like an employee 401K into an IRA, that limit I believe doesn’t count.

Jewels:

[18:24] I believe that’s correct because those are both pre.tax money and one was contributed a different year. So it’d penalize you if they did not allow you to roll that.

Maggie:

[18:33] Yeah because whenever you quit a job you have the option of rolling over your 401K into your own individual retirement arrangement.

Taylor:

[18:45] So I tried to roll over my 401K when I was trying to get it into my Charles Schwab. It took them months and months and months. Remember that there was that whole debacle?

Jewels:

[18:51] No wet signature apparently.

Taylor:

[19:01] No wet fucking signature. But, I was… I wanted to do it before the end of the year and it didn’t end up getting through the end of the year, so then I got pushed into January. But if I roll over it into my Roth now, will it tax me on my income for this year, or can I still apply it to last year’s?

Jewels:

[19:08] So retirement contributions and rollover contributions are treated differently. I believe the Roth rollover has to be done within the calendar year of your taxes. So the deadline for that was actually the end of 2020. But adding additional contributions for 2020 up to the limits can still be done now, up until tax day.

Becca:

[19:44] One thing I didn’t know about last year and now it doesn’t mean anything because the December 31 2020 has passed. But because of COVID, did y’all know this? That you could pull out money from your retirement accounts and only pay the taxes, but not the penalty fee.

As long as it had something that if you had like a COVID hardship, you could pull that money out.

Maggie:

[20:06] I hought it was as a loan. Like you can take out a loan against yourself, essentially.

Becca:

[20:08] Oh, maybe it was as a loan and I misunderstood.

Taylor:

[20:15] Loans against yourself are the most insane thing I’ve ever heard.

Becca:

[20:18] But kind of cool because you’re getting the money, you’re the loan shark in this case.

Maggie:

[20:20] That is one thing.

Taylor:

[20:21] There’s got to be a fucking catch.

Maggie:

[20:32] That’s one thing I actually don’t know much about because I’m like, it seems like there’s something wrong here. Like, I’m going to be paying some kind of price for this. So I’m always just like, I’m not gonna do it.

Taylor:

[20:34] I’m not going to do it.

Jewels:

[20:39] I believe there are a lot of restrictions and potential penalties.

Maggie:

[20:41] Yeah, yeah. So I’m just not going to do it, listeners feel free to research that on your own.

Jewels:

[20:45] More money into the retirement accounts to compound over time is really the end goal and minimizing taxes along the way on your retirement.

Becca:

[20:53] One thing that was really relevant for me – because if y’all remember our loyal listeners – at the beginning of this podcast, I was trying to figure out what sort of investment account to start, and I landed on general investing instead of a retirement account and at Roth IRA or traditional IRA, because I wanted the ability to pull out that money if I wanted to buy a house. So, now that I am seeing the benefit of the retirement account, I want to switch that money, some of that money, over to a Roth IRA all on Betterment. That’s where my general investing is, and that’s where I want to keep it. But with the $6,000 cap, I can’t just move all of my general investing into retirement, right? It has to be done in pieces, but as someone managing, as you yourself, creating your IRA and managing it, if I – I am going to split mine between a traditional and a Roth, but you cannot exceed $6,000 limit and it’s on you to make sure you don’t. So if you fuck up and you put too much money in, then you gotta pay for that shit. And uh yeah, so if you remove and y’all, please correct me if I’m wrong on any of this, but my understanding – let’s say I didn’t know there was a limit and I put $10,000 into my Roth not realizing and I just let that go because I don’t know. In order to pull out any money from your Roth, you’re going to be paying that 10% penalty fee, right? If it’s a premature pullout.

Taylor:

[22:37] Yeah.

Becca:

[22:45] So you’re already paying that. So let’s say uh you don’t know that you over… that you’ve over invested one year and you let that ride for a year. You have to, and then you realize it. You’re taxed, or you’re penalized an additional 6% on the gains of that investment for every year that it stayed invested. So uh, yeah.

Jewels:

[23:11] This is an accounting nightmare.

Becca:

[23:17] Yes. So you have to go in, you pull out.

Maggie:

[23:18] Taylor, your eyes are so wide right now.

Taylor:

[23:17] I kinda don’t want to ever put in money. Well, how would you know if you’re putting in a little bit here and there throughout the year?Becca:

[23:27] Well you just have to be super mindful. You gotta keep track of it.

Taylor:

[23:28] Is there like a history page where it’s like, this is good.

Maggie:

[23:31] Yeah. It’s the digital world. There is. You can find all of the information.

[23:31] Why wouldn’t they build that in?

Jewels:

[23:39] Okay. So typically if you’re a normal employee, your company does the withholdings, HR helps you set up the amount per paycheck for that. So it’s going to be within the limit. We’re talking about an individually managed thing such as… was it Betterment?

Becca:

[23:53] For a Roth IRA, or no, that…

Jewels:

[23:56] If you, if you over contribute to a traditional IRA or a Roth IRA, any retirement specific account that has a contribution limit, you will find yourself in that mess.

Taylor:

[24:08] But as Maggie was saying, it doesn’t count if you’re rolling over 401K into a traditional right? So, like that $2500 that I rolled over from my 401K into my traditional rollover account. That doesn’t count as part of that $6000 or does it?

Jewels:

[24:25] We believe it does not because that money was all contributed in a different year so it counts against that year’s contribution limit.

Taylor:

[24:25] Okay. Got it.

Maggie:

[24:37] And you can roll over your traditional IRA into a Roth IRA similarly.

Taylor:

[24:44] That is so stupid. Why are they preventing me from putting more money in my account? What is the motive? Why would you have an account where you where you’re like you can only put in $6000.

Maggie:

[24:52] Oh, because I mean it’s the tax advantage, not like… the government is only going to allow so much tax advantage shit to go on because they want the taxes.

Jewels:

[25:06] Two things. They want the taxes…

Taylor:

[25:06] You’re going to be into paying the taxes either way though eventually… either before or later.

Jewels:

[25:17] Right, but what they actually care about is the amount of money in circulation in our economy. They want money being spent because we live in an entire global system where GDP is the ranking of countries, and the power that countries have in global economics, so they don’t want you saving all of your money because if everybody in the country saved all of their money and nothing is being spent, our GDP tanks and our power in the global economy tanks. I believe – anyone correct me.

Becca:

[25:42] And then we can’t beat the Russians to the moon and that’s all that matters.

Jewels:

[25:45] Yeah.

Taylor:

[25:46] We’re still trying to get there.

Maggie:

[25:49] Yeah. I just think they’re… I mean from the government’s perspective there has to be some kind of limit on the tax advantages that they will just hand out. It’s like the 401K is a benefit of a job that your employee can choose to give you or not. And so that’s kind of like the same thing with the government offering these tax advantages, it’s like, this is a benefit that you get being an American citizen. We will give you this amount of money in a tax advantaged account each year if you choose to use it.

Taylor:

[26:22] It’s also fucking arbitrary. Like, everything is a lie. It’s all just arbitrary rules that people set up for us so that they could fucking win the game and then they don’t teach you the rules to the game.

Becca:

[26:34] That is true.

Maggie:

[26:36] But Taylor, we’re learning the rules.

Taylor:

[26:39] We’re learning the rules now, halfway through our lives.

Jewels:

[26:46] Look, her age estimate of death has suddenly got more optimistic.

Maggie:

[26:48] I was literally doing the math, I was like 75% maybe… I don’t know.

Becca:

[26:52] So yeah, I think in conclusion with my little monologue was just be mindful when you invest in these accounts because it’s something that had I not looked more into I could have easily made that mistake of over investing in a Roth, or if you’re opening, if you want to do both the Roth and the traditional, make sure you’re only putting three grand in each. You’re maxing out at three grand in each for the year.

Taylor:

[27:22] So it’s any any IRA account? I did not realize that.

Becca:

[27:23] Yeah so definitely be mindful of that.

Taylor:

[27:36] That’s good to know because I’ve been putting money in both throughout the year and not paying attention how much I’m putting in. It’s not six… I mean it’s… I don’t think it’s over six grand but that’s really good to know. Fuck, goddamn it.

Jewels:

[27:41] Well you should sit down and take a look at it.Becca:

[27:42] Yeah just make sure..

Jewels:

[27:45] You’re being too good now Taylor.

Taylor:

[27:46] Uh, I got to spend more money on stupid shit.Becca:

[27:48] The government wants you to.Taylor:

[28:01] Um, one thing I did find interesting in my research talking about 401K, there’s also something called a solo 401K account.

Jewels:

[28:02] That is for self-employed people.Taylor:

[28:13] That’s what I’m finding out or, and yeah an individual business owner without any workers.

Jewels:

[28:16] Exactly. So, for self-employed people there are two main types of retirement accounts to look at. There’s the SEP IRA which functions like an IRA however it has much higher contribution limits, which is very nice than for a typical employee.

Taylor:

[28:24] And that’s designed for small business owners?

Jewels:

[28:28] Exactly. Small business owners and their employees as well if you have more employees and then the solo 401K you’re only eligible for if you are self employed as the only employee or your spouse is the only other employee, then you’re eligible for the solo 401K.

Taylor:

[28:45] Is that what you have? Are you eligible for it?

Jewels:

[28:46] I currently have zero retirement accounts set up.

Taylor:

[28:50] Oh my God. Living on the fucking edge Jewels.

Jewels:

[28:53] I know. I know. Well because most of my cash, my investment cash, I want to put in real estate now and then I will start working on my retirement contributions. The SEP IRA contribution limits of this for self-employed people, I believe is $58,000 in 2021. But, it’s only the employer side who contributes over self-employed, some accounts the employer contributes, the solo 401K – both the employer and employee contributes. So I would contribute as both the employer and my own employee. But for the SEP only the employer contributes and it’s 25% of your adjusted income up to $58,000. So if you have a low self employment salary, you’re not gonna able to contribute the full $58,000, but you’re still likely to be able to contribute more than the $6000 for a normal IRA, so that’s a great benefit. For the solo 401K you get to contribute the normal 401K limit, which is $19,500 this year and as the employer, you also get to contribute 25% of the employee compensation.

Becca:

[30:08] Damn.

Jewels:

[30:09] And then those two combined max out at $58,000.

Taylor:

[30:13] So that’s all pre-taxed income, pre income to pre tax.

Jewels:

[30:13] So these could be either traditional or Roth.

Taylor:

[30:26] So you either do decide to pay the taxes when you put it in, or you don’t.

Jewels:

[30:34] Right. So you can have a traditional solo 401 K or a Roth solo 401K.

Taylor:

[30:41] Interesting. So, if you had like, if you were like, a pretty low income earner as a self-employed business you would want to do Roth where you pay the taxes now and you don’t pay them later.

Jewels:

[30:44] Most likely yes. Yeah. Any low income years, it can be advantageous to put the money into a Roth instead of a traditional. So you take the tax hit now but you lock in that low tax rate.Taylor:

[30:58] I do think it can get very confusing and scary with all the different types of accounts and all the rules around them. But I think one thing that’s super helpful is you know, figuring out how much you make and what your tax bracket is and then think about what your plan is for, you know, future income. If you… you know say for example you’re training to do a new job or you’re switching careers and you’re trying to make more money and you assume in five years or so you’re going to be at a higher, um you know, taxable income, then maybe you should look at setting up accounts now that will… you pay the tax now and not when you pull it out later. And, or you know if the opposite, if you’re going to be quitting your job in five years and traveling the world then maybe wait and get a traditional versus the Roth. So it’s all something to consider. Like, I think if you’re worried about how to start off, just figure out what your income is now, what you want it to be in the future and then also just talk to your bank because like, I never want to call my bank, but when I do they’re always really helpful in explaining things to me. They kind of have to… you know like the chats I’m just like, but, but tell me exactly what you mean by that and they have to sit there and talk to you for hours, it’s fun to torture them. But yeah, because I can see I can see people listening and being like very overwhelmed by all of the different stuff, but I think just starting off with what is your income, what is the government taxing you for that and then what do you see yourself doing in the future then, figuring out what works best for you.

Maggie:

[32:46] I agree. It’s very easy to be overwhelmed by it. Um, but with that said, I don’t think you can go wrong by saving money. So no matter what you choose, even if it’s the wrong choice and you figure that out next year down the line, at least you’ve got a head start at that point.

Taylor:

[32:53] And you can always move your money around too, into other accounts.

Jewels:

[33:06] And I don’t think wrong is maybe the right word, but maybe less optimal choice if you then realized there was an even better choice, then, you know.

Maggie:

[33:09] Oh story of my life. This is… we talked, we talked about, when we first started this podcast, our biggest financial regret and mine was that I was high income earning and then I took a year off and didn’t know about this Roth conversion situation and so I could have potentially have a bunch of non-taxed money that now I have lost that opportunity for.

Taylor:

[33:41] Yeah. And if you’re unsure, just call up your richest relative and ask them, because I guarantee you they know. Those fuckers, they pay someone, but they know because those fuckers always know how to save more money and they don’t tell you. So you got to ask them, call up the richest person, you know, they fucking know shit, they’re not telling us.

Jewels:

[34:01] I did run a quick calculation to compare the self-employed amounts that you could put away and, so if you’re adjusted compensation as the employee of your own company was $30,000, if you did the SEP IRA, the amount you could contribute, which is the employer side, contributing 25% of your compensation would be $7500, so it’d still be better than a traditional one as an employee of another company. But for this solo 401K you could contribute $27,000 to your retirement in one year on a $30,000 adjusted salary, because you could contribute the $19,500 as yourself and then your employer could also contribute the other $7500. That’s a lot of money to be able to put away in a single year as a self-employed person.

Taylor:

[35:02] So, sorry, this might be obvious, but what’s the benefit of like putting that in a retirement account versus just like a savings account here?

Jewels:

[35:03] It would be better to compare and invested 401K with a non retirement investment account, so like, your Charles Schwab, if it’s a non retirement one, your real advantage is that you get to, if you do a traditional retirement account, you don’t pay taxes on it this year and it lowers your taxable income for the year. So that’s a that’s a big advantage. That’s a big difference.

Taylor:

[35:05] Is it only an advantage if if puts you in a lower tax bracket?

Jewels:

[35:06] No, so what it means is that you get to put… you get to invest more money because you didn’t have to pay taxes on it, than you would have been able to invest because you had to pay tax on it, right? So this is what I was saying earlier when I said like, out of a dollar, if you put it in your normal investment account and you’re taxed at 15%, then you get to only invest 85 cents. But if you put it into a traditional retirement account you get to invest the full dollar now because you’re not on the hook for taxes until retirement.

Maggie:

[36:06] In compound interest baby.

Jewels:

[36:06] Yeah. So you get to invest more money earlier, which compounds and ends up being a lot more money later.

Taylor:

[36:14] Got it. So invest that money in your retirement accounts. So should I even have investments in my savings accounts or should I just put it all in retirement accounts and invest it there?

Jewels:

[36:25] Depends how much money you have because we’ve got those contribution limits right? So max out your contribution limit and then if you have access to invest you can put in your regular investment account.

Maggie:

[36:36] I feel like if you have the opportunity to put money in a tax advantaged account after you’ve paid off your credit cards and your bills and all the other steps, you should probably take first, then you should use a tax advantaged account over a non tax advantaged account.

Jewels:

[36:53] And, I also believe a lot of the retirement accounts, the gains you’re making while it’s invested, you’re also not taxed on. Whereas in your regular investment account, sometimes those gains can trigger taxable events. So while that money is growing, it might be getting taxed. But if it’s in a retirement account that money can be shielded from taxes until retirement.

Becca:

[37:16] Until retirement being the key part of that phrase.

Jewels:

[37:19] Right, but in retirement is only taxed as your ordinary income when you pull those gains out.

Becca:

[37:25] Got it. Got it. Got it.

Jewels:

[37:25] Whereas in your regular investment accounts, you can have taxable events that trigger now and even although you paid income taxes on that money now, whenever you pull it out, you’re going to pay the capital gains.

Becca:

[37:29] Right.

Jewels:

[37:37] In addition to whatever taxable events happened in the meantime, in that account.

Becca:

[37:41] Got it. That makes sense.

Jewels:

[37:42] So there’s many different types of tax implications happening in your regular investment account that aren’t shielded.

Becca:

[37:47] Yeah.

Jewels:

[37:50] But in a retirement account it can potentially be shielded.

Becca:

[37:55] I will say that doing the research for today has definitely convinced me to open a Roth IRA and a traditional IRA in my Betterment account and max out with $3000 in each and that’s just,I’m just going to transfer it from my general investing account because now I have a better understanding of tax advantaged accounts.

Maggie:

[38:15] I’m curious and I would have to really think about this and do the math. But just something for you to think about before you do 3,000, 3000, There might be benefit to doing $6000 in traditional.

Becca:

[38:32] What do you mean if my income next year is low enough to handle?

Jewels:

[38:34] Like, if you decide okay, I’m within this tax bracket, I have this much space before I max it out. That’s enough space for me to roll it over without increasing my tax liability.

Becca:

[38:40] All right, cool.

Maggie:

[38:43] And you get one rollover per year, I believe. So you could roll over $6000 community traditional to your Roth and contribute another $6000 to your traditional next year.

Becca:

[38:45] Interesting. So, I know you explained this earlier and I don’t think I internalized it. If you roll over…So I put in my $6000 tax free into my traditional, then I decide to roll over 2021 taxable year into Roth. I don’t pay taxes when I pull that out. Why? Like, where’s the fee?

Jewels:

[39:22] You do pay taxes on the money that goes into the Roth because putting it into a Roth triggers the taxes, but if you’re within that lower tax bracket, it might be worth it.

Becca:

[39:31] Okay, so the point is that I can control… okay, see, so my instance, I’m almost positive my tax bracket will be higher, barring any more pandemics. That my tax bracket will be higher next year, for 2021. Yeah.

Maggie:

[39:49] Then, yes, so yeah, you should just do the Roth then. Just put all $6000 in Roth.

Jewels:

[39:53] Although, so the other thing and usually you wouldn’t like put money into a traditional for one year and then roll it immediately the next year. The Roth conversion ladder is usually based on a set of higher income years, followed by a later set of lower income years or periodic lower income years. So, like the example we’re talking about with you, where if you had $6000 in your traditional this year and rolled it next year, you get a little bit of a benefit because it got to compound at a higher amount for one year before you rolled it.

Becca:

[40:27] Yeah.

Jewels:

[40:29] But, it would be even better if you had like 10 working years, all of that money compounding that whole time and then five or 10 years or periodic years with lower income and then you roll it during those particular years because it’s already been compounding for a decade, so that’s like a really big difference.

Becca:

[40:41] Yeah, yeah.

Taylor

[40:47] My understanding too is that if you’re one of the big benefits – and I could be totally wrong on this – is that if you’re pulling out money and paying taxes on a traditional IRA, you’re going to be paying more later on in life than you would earlier on in life because of the inflation rate and just everything being more expensive right? Wouldn’t you? Like the tax… won’t taxes be like…

Jewels:

[41:18] A lot of this is trying to predict the future, which none of us can do, which why you have a lot of the financial…

Taylor

[41:22] I beg to differ.

Jewels:

[41:26] Which is why a lot of the financial advisors currently are recommending tax diversification, put some in Roth, put some in traditional, but, for the early retirement crowd, if they know that they’re going to have high income years and then take a bunch of time off pre-retirement, they kind of know that they’re going to be in the lower tax bracket, there’s always going to be pretty low tax brackets, even if the higher ones bump up. So they’re kind of taking that into their locus of control. But it is a really big risk to run if you’re going to put all of your money in traditional, never move it into a Roth and then bank on whatever the tax rate is by the time you retire. With traditional retirement accounts, you also have required minimum distributions that kick in at a certain point in retirement where you don’t get to choose how much you take out,

they’re going to tell you based on life expectancy and the amount of money in your account that you have to take out this much this year and that much next year and that can set your tax bracket and you have no control over it.

Taylor

[42:27] Right, interesting. So what if you never retire?

Jewels:

[42:31] Not an option. You may stop working but you reach retirement age and if you have traditional retirement accounts required minimum distributions will kick in and that money will bump you up even further in your tax bracket if you’re working and earning income because those will add up.

Maggie:

[42:47] Yeah, they.. once you hit retirement age you’re required to take certain amounts per year out.

Taylor

[42:47] Right. Oh, so interesting. So if you’re still working at retirement age, you’ll be paying a lot more taxes on that money you’re taking out.

Jewels:

[42:53] Potentially, because your income from your job will be added with your required income that you’ve been forced to pull out of your retirement account and then you will be taxed on the total of those. So you might be paying a lot more in taxes on your retirement than you planned.

Which is why it’s a good idea to try to move it into a Roth using a few different strategies on the way so that you have more control.

Maggie:

[43:22] Yeah, let’s get it confusing again.

Jewels:

[43:28] Like you pick how much it’s getting taxed based on when you move it into the Roth as opposed to waiting for retirement and seeing what happens with your traditional.

Taylor

[43:36] Right, interesting.

Jewels:

[43:40] Dun dun dun!

Maggie:

[43:40] Yeah, like my goal is to eventually have everything in a Roth, but to figure out how to be strategic about when and where and how I do that and it will probably take a long time to make it all happen.

Jewels:

[43:40] Right. If you have any opportunities to contribute initially to the traditional but somehow have it end up in your Roth before retirement, that is the ideal scenario.

Becca:

[44:05] Mhm. Yeah. So a lot of people that might listen to this are people like us who daydream about taking a year off to travel, taking a year off to do whatever. Maybe two. What’s the whenever… you rear your children, right?

Jewels:

[44:20] Child rearing.

Becca:

[44:23] If you ever, yeah I was trying to remember the word rear and then once I realized, I was like that can’t be right. But it is.

Taylor

[44:24] Take a year off once you have a kid.

Jewels:

[44:24] It’s so similar to childbearing but sounds so different.

Becca:

[44:29] Oh yeah.

Taylor

[44:30] Sneering, sneering a child.

Maggie:

[44:35] I don’t I want to rear a child.

Becca:

[44:38] If you anticipate intentionally or unintentionally taking a year off or multiple years off, then starting with a traditional IRA might be the right call for you so that you can take advantage of that very very low income, potentially zero income year to convert over to Roth IRA and maximize your tax benefit. If all of this is too overwhelming we’d encourage you just to pick one and you’re going to be fine.

Maggie:

[45:07] Learn as you go.

Jewels:

[45:10] I think biggest priority, like Becca mentioned earlier, if you are an employee and your company will match a portion of your contributions, 100% max out the amount required to get that free money.

Becca:

[45:22] And that’s the 401K.

Jewels:

[45:25] Correct. I do think we should talk about Maggie’s favorite retirement account.

Maggie:

[45:31] HSA

Becca:

[45:31] Yes. Tell us.

Taylor

[45:33] That’s a whole other thing.

Maggie:

[45:37] I mean, I’ve talked about them before in previous episodes so I won’t dive too deep into them but it just says health savings accounts can be used in a very interesting and fun way, but not for everyone. Like if you have a lot of health issues, HSAs usually come with a high deductible so it might not be right and it might not be advantageous for you to choose a HSA path. But if your medical bills are generally somewhat low or you know, you’re not planning on having a new baby child in your life anytime soon. Something… big life event coming up. An HSA might be a good choice because without any conversion ladders or backdoor, mega ultra confusing lingo language you can contribute to an HSA tax free and at retirement age, pull out the money tax free. Another cool thing about the HSA is that it’s set up so that you can pay medical bills tax free. That’s the whole idea.

Becca:

[46:34] Double tax free baby.

Maggie:

[46:45] But, there’s no time frame of when you have to pay for those medical bills. So say this year, for example, Maggie had a $1,000 MRI. Well I can save that receipt, contribute, pay out of pocket, contribute to my HSA all year, and then say in 10, 20 years I decide I need $1,000 I can submit my receipt and take that $1,000 out then. So that means that I just let $1,000 grow in a tax advantaged account for 10 years tax free and then pulled it out later.

Becca:

[47:18] That’s so fucking cool People don’t know this.

Maggie:

[47:21] Yeah, you can only contribute $3,700 a year.

Taylor

[47:21] How is that possible?

Maggie:

[47:26] But I max it out every year and do my best not to pull anything out of it and save all my medical receipts, so you can do that, and then if you end up not using up your HSA fund with medical bills, it converts basically into a retirement account at retirement age. So then…

Taylor

[47:44] So you don’t even have to use it on medical bills after a certain age?

Maggie:

[47:48] Yes. But, you could never put an HSA into an IRA. That’s not a possibility.

Taylor

[47:58] Okay, interesting.

Jewels:

[47:59] You can move it to a different HSA if your plan provider changes for some reason, like your job changes and they have a different HSA, you can move it into that.

Taylor

[48:03] Right, wow. So it’s tax free going in and tax free going out.

Jewels:

[48:11] Yes. And the money is accessible in the meantime, if you’ve had a medical expense and you need to pull that money out without penalties or taxes.

Maggie:

[48:17] Accessible. Tax free.

Taylor

[48:18] You just have to submit a receipt. Do you have to have the physical receipt or just a digital copy?

Maggie:

[48:25] Digital works too, yeah.

Jewels:

[48:26] Usually it’s a digital portal that you upload it to anyways for most of the providers now.

Maggie:

[48:31] I mean a lot of…

Taylor

[48:31] Sorry – so you can just open up an HSA like as an individual or you have to have an employer.

Becca:

[48:38] You don’t have to have an employer, but – right?

Maggie:

[48:41] We’ve researched this before. Mine is through my employer.

Becca:

[48:42] So you do have to have a… health care account that is a specific…you go.

Jewels:

[48:52] You have to have an eligible health care plan. So that typically requires a high deductible.

Taylor

[48:57] Oh, I was reading about that in my… yeah.

Jewels:

[49:00] Yes. So depending on what your health insurance is, you can find out if your plan is eligible for an HSA. If it is, 100% go open that account and fund it. The limit is pretty low. Each year, you said like $3700 for an individual?

Maggie:

[49:18] Yeah let me double check.

Jewels:

[49:19] And maybe like $7400 for a family. But the tax advantages are great and the flexibility of that plan because you can access that money in the meantime if you’ve had medical expenses is also really helpful.

Maggie:

[49:34] For 2021, max HSA contribution for an individual is $3600.

Taylor

[49:41] So does it change every year?

Maggie:

[49:43] Yeah it’s kind of like the same as 401K. Max contributions change every year, the IRS decides and it usually goes up by a little bit each year like, $100 – $200.

Taylor

[49:53] So do you know, do you get notified or you just have to like sort of like research?

Jewels:

[50:05] They usually tell you, they definitely tell you before… so a few years ago the max contribution limit for a 401K was $18,000 and now it’s 19,500. So they’re just bumping it up about $500 a year I think right now just to kind of keep up with cost of living increases. And just as a reminder, putting money in your HSA does not mean it’s invested. You do have to go in there and actually invest the money. That is similar with like your IRAsand stuff. Make sure you’re not just contributing but actually making sure that money is being funneled into an investment, so it compounds.

Maggie:

[50:40] Yeah and the other… and it does lower, like it’s the same as the other retirement accounts we were talking about where um, that $3,600 is now not part of your taxable income for that year because you’ve contributed it to your HSA which is never taxed.

Taylor

[50:55] So do you have to go to your employer and ask them if they have HSA options? Or do they usually wrap that into getting a job?

Jewels:

[51:05] When you become an employee, they typically present you like, a benefits package that shows you the health plan options, you can get through them so you can look through those. Typically, there is a high deductible one and you can go with that. You also don’t have to take your employer provided health insurance if you prefer to go directly to the market, but it’s usually beneficial to let them pay for part of it if they will. The other thing that’s really interesting about the HSAs is because of the ability to invest it and let it compound over time if you don’t touch it eventually, ideally you can have enough money built up in there that just the gains each year cover your medical expenses for the year without ever touching the principal. So basically you pre-invest that money and then each year later in life when your healthcare expenses go up, just the gains from that year should cover, ideally – will cover your health expenses for the rest.

Maggie:

[52:04] That’s actually how I accidentally stumbled on the greatness of the HSA. I learned you could invest it and I was like, oh, if I invest it for a long time, then eventually, maybe it’ll be making like $2,000 a year and then I can just always have my medical bills covered, assuming you know, nothing terrible happens to me. And then I found out about all the tax advantages and I was like, oh shit, yeah, this is awesome.

Taylor

[52:31] That is really cool.

Becca:

[52:33] To go further with your question, my… so I get my healthcare insurance through my employer and it’s a high deductible so it’s HSA eligible. And when I asked, I was like hey… how do I… what do I do? They were just like yeah you can pick any brokerage and just start an HSA account. So they didn’t do it for me, they didn’t provide anything, they just told me I could.

Taylor

[52:59] How does how does your bank know, they like contact your employer or how do they…

Becca:

[53:02] Yeah.

Jewels:

[53:03] Well, there are specific banks who offer HSAs… specific financial institutions that offer HSAs.

Becca:

[53:07] Which I try to do, I think going with Lively…. I haven’t actually done my HSA contribution for the year but I’m going to, I think I’m gonna go with Lively through Ameritrade because I tried to go through Fidelity and because they didn’t recognize my bank, I’m at a credit union, they required me to fill out a form, a paper form and mail it to them and like the idea of having to do that was so offensive to me.

Jewels:

[53:37] At least they didn’t say fax it. We once rented a car in Barcelona, this was probably in 2013 and they wanted us to fax them paperwork while on vacation in Barcelona, we were like, excuse me, no. I’ve heard really great things about Lively.

Becca:

[53:48] Good. Yeah I’m excited, I’m excited to go with Lively though I did look at my Mint app which tracks my budget and they don’t recognize Lively as an account so it won’t be a part of my net worth tracking, which is annoying but it’s still going to be fine.

Jewels:

[54:20] Now we get to find out if Becca decides to change to something like.. is it Personal Capital the other big one? Maybe they have a Lively integration? Or start hassling men to be like, please hook into the API.

Becca:

[54:30] Yeah, I need to hassle a lot of things.

Taylor

[54:37] Okay, I’m looking at my history on my accounts. I have the IRA transfer from my 401K into the IRA account and then there’s a IRA regular contribution where I put in $1000 for this year, for 2021. But when I went (so that’s my rollover IRA account) When I go to my Roth IRA account, the only money I’ve put in was um.. February 10th I put in $1000. But it says IRA last year contribution, so I put 2020 as the contribution year. So that means that for my taxes this year for 2020 I only so far have put in $1,000, so I can still put in up to a certain amount but I have to figure out what that amount is.

Jewels:

[55:30] Right. So you could still contribute more for last year’s taxes before the tax day and then you could resume contributing for this year, up to the $6,000 limit or whatever it is.

Taylor

[55:31] Okay I need to figure out what the limit is and then put in the max.

Jewels:

[55:45] That would be great.

Taylor

[55:46] But do I want to put it into my Roth or do I want to put into my roll over?

Maggie:

[55:50] You think you’re gonna make more money next year?

Taylor

[55:50] Hopefully, yeah.

Jewels:

[55:50] Well, she’s talking about 2020 taxes, right?

Taylor

[55:53] Oh, that’s right. Which I didn’t make a lot at all, so I should put it all into my Roth.

Jewels:

[55:59] Yeah. So your income was lower last year. So a Roth is probably a really good option because that’s why you were looking at doing the Roth conversion last year, lock in that future tax free money.

Taylor

[56:05] Yeah. Okay.

Jewels:

[56:14] Okay. So I have admitted that I have currently zero retirement accounts set up.

Maggie:

[56:15] I have lots.

Jewels:

[56:22] Yes.

Becca:

[56:22] What have you got, Maggie? Hit us.

Maggie:

[56:33] Well, I have.. I do have one faux pas that I have had a 401K at the company that I used to work at and I should have converted it to a traditional IRA whenever I quit that job and I seriously thought about it. I called a bunch of bankers. I got very confused, they sent me many pages of paperwork and then I said fuck this, and so I just still have that money in that 401K. So I need to do something about that.

Jewels:

[56:53] I think that’s a very common situation with the paperwork.

Maggie:

[56:56] It was really confusing and also this is way before I knew anything about any of this. I hadn’t done any of the research and so I was like argh, it’s too much you know, I don’t want to do it. And so I have two different 401K accounts, one with my old employer, one with my current employer, and then I have an HSA account. And then I have non-retirement accounts, I have two different investment accounts, and um, a stock company… company stock account.

Becca:

[57:29] Yeah, that you have just through your employer. Nice. You’re so diversified.

Maggie:

[57:33] Yeah.

Becca:

[57:39] Oh yeah and she fucking owns a house, two houses really.

Maggie:

[57:39] A house and a half.

Becca:

[57:46] Yeah, I have a 401K through my current employer and have the exact same situation as Maggie where I had a 401K through an employer from… I left that job in 2013 and I had… I was a little baby at the time so I didn’t put much money in it and then I let it sit there for so long. And by the time I contacted them the financial person who had set up my account no longer existed, and so I called and they’re like, it was a different company and I was like hey I invested with this other company and they just never responded. So I went directly to the company that.. I think it’s Pacific Life that it was through and they were actually really helpful. So they sent me a ton of paperwork and I looked at it and I was like mmhmm – so I’m just going to let that ride. So that’s yeah, so I still have a small 401K account with a previous employer that I eventually one day will have the capacity to deal with. And then I’ve got a general investing account with Betterment that’s about 30% of my net worth. Um, and that’s what I’m gonna be transferring some funds to. I still think what my plan is is half into Roth, half in traditional and I’m going to max out for 2020 in the next few weeks and then before I file my taxes. Then later on this year I want to max out my HSA that I qualify for because I have a high deductible plan, and then max out once again the Roth and traditional IRAs. So I hope… I have so many fucking accounts. Oh my god I’m like addicted to making more I think. And then I have my fund money account on Public and that’s just for active investing where I make awful choices.

Maggie:

[59:42] That’s a lot of accounts. Did you count them? How many was it?

Becca:

[59:43] It’s so many. Well okay so here we go. So I’ve got Betterment General Investing. The only reason I’m doing my IRAs in Betterment is just so I don’t have to open up another fucking account because then of course I have my checking account with my bank and then I have a high yield savings account with Betterment and then I have my business checking account with my bank, and then I have a Lively account for my HSA and then I have my Public account for active investing.

Maggie:

[1:00:09] You forgot one – Crypto?

Becca:

[1:00:10] Oh, I have Crypto on two platforms. I have two Crypto accounts.

Maggie:

[1:00:15] So are we…

Jewels:

[1:00:17] 10 I think. 10.

Becca:

[1:00:18] I think we’re at 10. I have a Coinbase account and a Kraken account. There’s a lot of accounts.

Maggie:

[1:00:24] Wow, that’s a lot Becca.

Taylor

[1:00:28] Oh, speaking of Coinbase and Crypto, we should talk about retirement accounts that specifically allow for investing in Cryptocurrency – which there is only like one, right?

Becca:

[1:00:33] Good idea.

Jewels:

[1:00:38] There are a few more options. There’s one that is specific, I believe it’s called Choice or Retire with Choice and that is a retirement account that allows you to invest in all of the different types of assets all in one account. But they do charge – their fee structure is different depending on whether or not… this is gonna sound really weird – whether or not the Bitcoin that you have invested in the account is sort of like liquid or in cold storage. Um, so if you want it in cold storage you’re going to pay them more but if it’s liquid then you’re just going to pay a transaction fee whenever you make trades through Kraken who they tie into for the Crypto side. But in that account I believe you can invest in your traditional like, equities, you can invest in crypto, you can invest in gold, all of that kind of stuff. But there are other IRA options. I believe that you can also invest in cryptocurrency. Your 401Ks at this point typically are not going to have that option, but certain IRAs will because they’re so self directed.

Becca:

[1:01:53] What retirement accounts do you have Tay?

Taylor

[1:01:56] Um I have a Roth IRA. through Schwab and I also have a rollover IRA which I opened specifically to transfer over my 401K from my old employer into Schwab so it was just all in one place and I could have more control over investing. So, I think because 2020 was really low income for me I will… or lower income than hopefully next year, I’m going to try to put as much as I can into contributions into my Roth. So I pay my taxes now at a lower tax bracket. But I just want to, I think I’m gonna call Schwab to verify that the $2500 does not include my total contributions into my IRA because I don’t wanna fuck myself over and like, end up going over the, you know, the amount.

Jewels:

[1:03:00] It’s a great idea.

Maggie:

[1:03:01] I really appreciate your willingness to call and ask questions.

Jewels:

[1:03:04] 100%, because that is never me. I’m like, I will read wild speculation on the Internet and I will gamble on it before I pick up the phone to call the bank.

Taylor

[1:03:10] Oh no, I just want to talk to a human like, before I even look it up, I’m like – just someone tell me the answer.

Maggie:

[1:03:14] I also am not the type to call and ask questions when it is related to this stuff. But at work I find myself saying all the time, like if you would have just called and asked me, we wouldn’t be in this situation.

Taylor

[1:03:25] Yeah, yeah, but no one does that anymore.

Becca:

[1:03:35] Um, hey, so reach out if ya’ll any questions about retirement accounts, if you’ve got one, if you don’t have one, if you’re interested and just if there’s something we didn’t quite cover or you want more clarity on reach out, we want to hear from you. Send us a message on Instagram at @vaginancepodcast, go to our website vaginance.com, leave us a voice memo. You could be featured on our next episode vocally, orally.

Taylor

[1:04:01] Orally? Sexually?

Becca:

[1:04:04] You could be sexually featured. Um yeah, let us know. We’ll send you little postcards to, we love doing it.

Jewels:

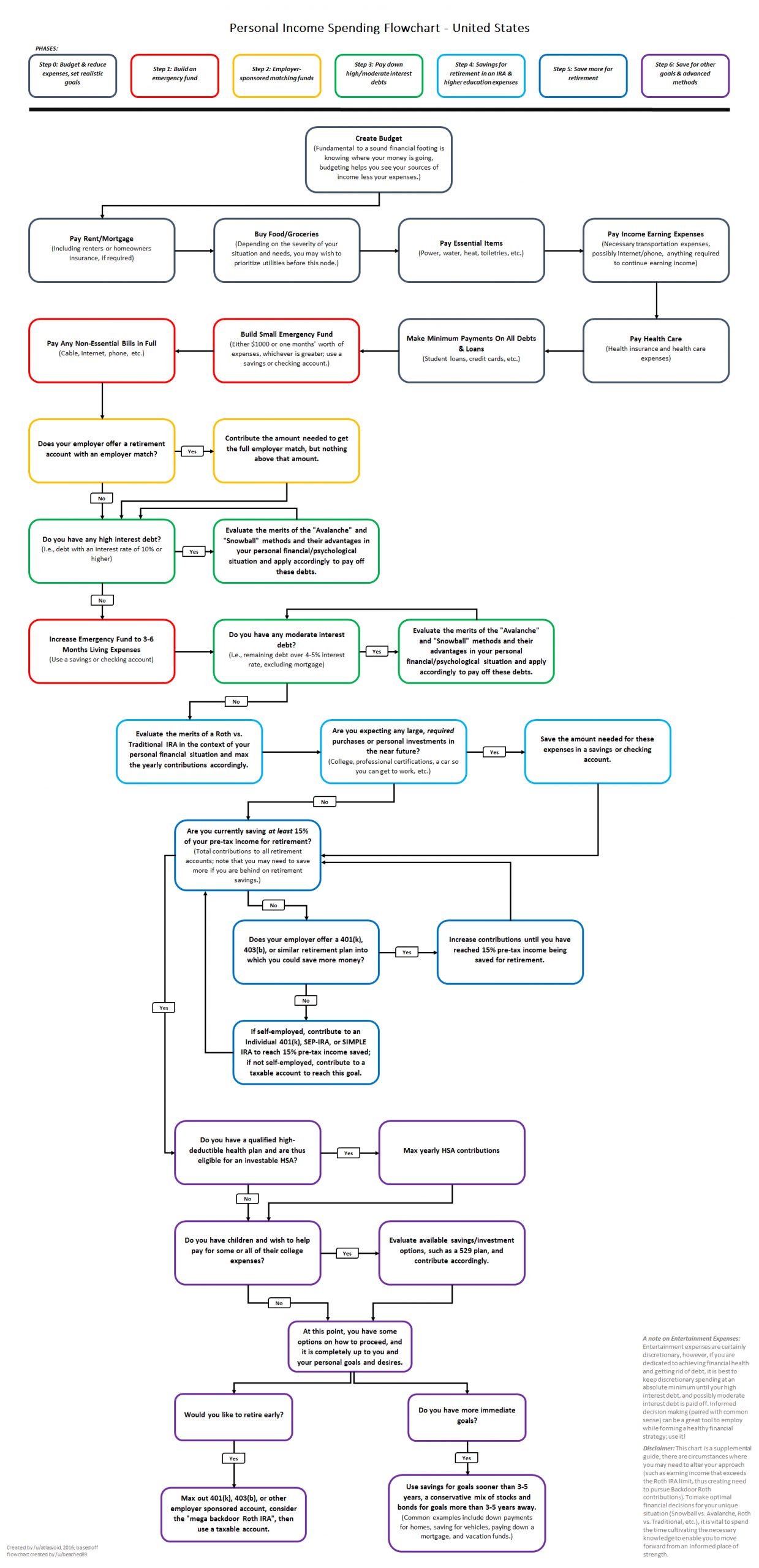

[1:04:14] In the show notes for this episode, we will include a breakdown of the different types of retirement accounts and their benefits and disadvantages. And I believe we also have some cool flow charts that will help you decide what to invest in first if you’re prioritizing where to move your money.

Taylor

[1:04:23] I love a good flow chart.

Maggie:

[1:04:34] We always focus on finance and never focused on other stuff, so…

Becca:

[1:04:39] Let’s do sex stuff, yeah, I’m having sex now, I’d really like to talk about it publicly.

Jewels:

[1:04:44] Oh, yes, yes.

Becca:

[1:04:55] Yeah.