Becca:

[0:02] Welcome to Vaginance, listeners we’re very happy to have you. Tonight we’re talking a lot about investment styles and our individual approaches to investing and where we lie on the spectrum of risk comfort versus risk averseness. And we talk about our experience with that and what’s held us back from investing or what has propelled us into investing in various different areas. And, I’m Becca.

Taylor:

[0:10] I’m Taylor.

Jewels:

[0:11] I’m Jewels.

Maggie:

[0:12] And Maggie.

Becca:[0:02] So okay, the one of the reasons that this idea for a podcast topic came to mind was I was reflecting on how the four of us and maybe those that we are in relationships with who affect our finances treat risk when it comes to money. Because I was thinking about my portfolio, I think about 2.5% of my net worth is in crypto, which compared to Julie’s… which I think you’ve said on the podcast, right?

Jewels:

[1:05] I’m not sure, but it’s easily…

Maggie:

[1:06] 9.9….

Jewels:[1:05] Easily, easily at this point because it’s also grown even more. I mean it’s really crowded out. We probably have less than 0.5% in anything else.

Becca:

[1:08] Yeah.

Maggie:

[1:11] Well not counting your house.

Jewels:[1:05] Yeah not including the house.

Becca:

[1:18] Yeah, so I think that shows a huge difference in like risk comfort and risk averseness. Um so that that would be an interesting thing to talk about because I know everyone listening probably is in a totally different spot on the spectrum of what you’re comfortable with, and what maybe is a blockade for you, because investing in general is a risk, like 100%. Um so I think maybe talking through it a little bit about why you’re comfortable with certain risk and not would be helpful for people because I know that was my biggest thing, that’s why it took me 31 years to get into it, is that was like well if I just hoard all my money then it can’t be taken from me, when of course we learn that with inflation, your money is being taken from you and the money that you’re hoarding is going to be worth less and less and less every year. So unless it’s growing even at a small steady rate, you’re losing money actively, the more you hoard. So 10 years of hoarding, 10 years of losing money on my end. Um so I was hoping I could talk a little bit about that and then get into the more nitty gritty about how we approach investing.

Jewels:

[2:24] So I think what you’re saying Becca is actually a really useful way to frame keeping money in savings – is that you’re not just storing money you’re actually investing, you’re choosing to invest in the US dollar.

Becca:

[2:28] Mhm.

Jewels:

[2:35] Without really assessing whether or not that’s the best investment you have available. And when you think about that as an investment, I think it can totally change the way you look at where you want to keep your money.

Becca:

[2:43] Yeah. Well, so what would we consider the least… well, it’s so subjective what’s considered least risky because a lot of people might argue that real estate is the least risky form of investment.

Jewels:

[2:50] I think that depends again if it’s leveraged real estate investment or a cash purchase on an asset that’s insured and cash flows, those are very different investments.

Taylor:

[3:10] It also seems very inaccessible to a lot of people. Compared to the stock market, like you can have $5 and invest in the stock market. You cannot have $5 and invest in real estate unless you buy a real estate ETF fund. But buying property alone, I think it’s a little more inaccessible to a lot of people that can’t necessarily afford houses or get a loan for a house. So while it could be long term a better bet it might be harder for a lot of people.

Maggie:

[3:41] I was going to say that about risk in general as some of my risk choices are made because of accessibility. Like I chose to invest in 401K because I was given that option, not necessarily because it was less risky, right?

Taylor:

[3:47] Right. Mhm.

Maggie:

[3:53] So, it’s just like circumstances have a big portion of play in how much risk you’re willing to take.

Taylor:

[3:59] Totally.

Maggie:

[4:00] So Taylor what’s your, what’s your risk levels on a scale of um, sitting at home alone in a bubble to mid COVID breakout concert, no mask.

Taylor:

[4:12] Like bubble man.

Becca:

[4:16] Oh yeah like Cancun Spring Break.

Maggie:

[4:17] Yeah. What are your risk levels of investing?

Taylor:

[4:20] Well, um I would say I’m probably in the middle, maybe like a um, 100 person intimate concert.

Maggie:

[4:25] Didn’t put on hand sanitizer after picking up your groceries.

Taylor:

[4:35] Yeah exactly. Yeah, like I’ll spend $300 on crap I don’t need but I won’t put $300 in something that isn’t like a index fund. Like if it’s like a meme stock, I’ll spend a little bit of money on meme stock. Actually, that’s a lie because I did spend like $200 on GameStop.

Becca:

[4:54] More than 200 bucks, right? Didn’t you spend like 600 bucks?

Taylor:

[4:59] It was in increments though, it wasn’t all at once and I did make all my money back and a little bit of extra, but not much.

Becca:

[5:04] And she made all her money back everybody. For the record. Well I feel like we’re also so new to the investing space we’re figuring out what our…own approaches.

Taylor:

[5:13] Yeah.

Becca:

[5:15] But I feel like you have, I would argue, a more balanced and maybe less risky approach.

Taylor:

[5:16] It depends on the day.

Becca:

[5:25] Because I know especially when we started talking about active investing because we all you know, we were super in on passive investing, investing in index funds and just kind of letting the market ride and investing in that ride broadly. And then once we started learning about meme stocks, GameStop was our introduction really into active investing basically. I know that your… immediately started leaning towards value investing right? In like wanting to know what a company is actually worth to see if you actually want to put money into it versus me, where I read a forum and some random 17 year old is like ‘Invest this fucking meme stock man it’s going to blow up’ and I’m like, okay I’ll do it.

Taylor:

[6:06] But I love, I love that you do that though, because I love like being like on the outside, like watching it, I’m like what happened?

Becca:

[6:08] Well I lost money. That’s always the answer. So yeah. It seems like value investing is one of your preferred ways of moving forward and now you seem to lean really heavy to ETS. You always are finding new ETS to invest in.

Taylor:

[6:30] Yeah, there’s just so many interesting ETFs that I think are fun, that give me the thrill of like uh… like fun and active investing. But I feel like I’m still hedging my bets on like a lot of different businesses so I feel more comfortable putting my money in them. So it’ll be like ooh this is a really cool like you know um, like storage facility ETF.

Maggie:[6:53] Very interesting.

Becca:

[6:44] Very cool.

Taylor:

[6:52] That’s like specifically like digital, there’s like there’s like digital storage ETFs, and like uh, that specialize in like cold storage and I’m like that’s cool or like I’ve been doing a lot of water ETF investments because I feel like water is just like we’re going to fucking need it, you know?

Jewels:

[7:11] Yeah, yes ma’am.

Taylor:

[7:12] Um, so yeah that’s what I find a lot of fun and like researching but I still I have not finished ‘Invested’ the book, but I still need to fucking figure out how to actually value a company appropriately because I still have no fucking idea how to do that.

Becca:

[7:27] Dude, Andy listened to that book and now he’s got a fucking spreadsheet and he like evaluates companies when he wants to invest in them.

Taylor:

[7:30] Really? Oh my God, he didn’t even tell me, I’ll just ask him to tell me how to do it.

Becca:

[7:38] Yeah. He probably, I’m sure he’d share it with you. I think he really enjoys it because I’ll ask him like can you just evaluate this company real quick? Yeah it’s cool.

Taylor:

[7:42] That’s amazing. I need to finish the book too, I actually did really enjoy the book. I just got distracted with dumb shit, but.. as usual.

Becca:

[7:46] Like going to Costa Rica for two weeks?

Taylor:

[7:57] Yeah, like that.

Becca:

[7:57] And then Taylor also has real estate so that also goes into how you approach investing. It’s not when… especially when you bought it was not a low risk situation.

Taylor:

[8:02] True. It was weird though, I feel like I get in these moods where I’m like, I really want to do this and it’s all I can think about and I get obsessed with it. And I, when I moved back, I think it was such a huge like adjustment emotionally, physically, everything, that I wanted to feel like I was moving forward in my life, because I was coming back to Austin, I was coming back to somewhere where I spent a lot of time when I was younger and it felt like I wasn’t sure if I was making the right decision, because I didn’t know if I was just like going backwards, you know, like, oh, I’m just moving back home, and now I’m back in Texas and I’m not like trying new things, so I think that was kind of probably the spark that was like, I need to do something different, I need to buy a house, so I feel like an adult and I’m not just like, like living in my parents and like I’m back in college and you know, don’t have shit to show for it. So I think that’s probably what really motivated me to do that and then, you know, Zach being a real estate agent helped a lot, because real estate, most real estate agents are terrible, so him, like knowing so much and be able to help me out a lot was like a huge factor as well. And then I just saw the house, I saw my house and I was like, this feels right, you know, because I was looking for so long and nothing like quite fit, and then um when I saw the listing for my, for the house that I own now, I was like, it was like a good price, it was in the area I wanted to be. Yeah.

Becca:

[9:29] Nailed it. Well, and you closed on it a week after. Or you, you submit an offer the week after the city shut down for COVID, closed on it a couple weeks after that.

Taylor:

[9:39] Yeah, that was probably yeah.. dumb.

Becca:

[9:42] Well, that’s the thing, it was a very high risk thing and oh my God, it’s paid of, like holy shit, your house has increased in value dramatically, really dramatically.

Taylor:

[9:47] Yeah, it’s…

Jewels:

[9:54] But it was ballsy because you were you had just re-skilled, still trying to decide what your career trajectory… pandemic, global pandemic had started and you still went for it.

Becca:

[9:55] Very ballsy. And it was the right call.

Taylor:

[10:07] Yeah, there… I think there’s like a certain amount of like denial that you have to like… be in a state where you’re like, I can do this, like you kind of like amp yourself up, yeah, I can do this and then, you know, it’s like a delusion that…

Maggie:

[10:22] If today Maggie talked to day-buying-house Maggie I would be like you’re going to need more money than that. I was like no it’s fine. I think I like literally spent every dollar in my bank account to get the house and was like hope nothing breaks until I get paid again. Like. Yeah.

Becca:

[10:36] Whoa.

Taylor:

[10:40] I sold my Dad’s gold so I can make it even half the amount that I needed.

Maggie:

[10:44] Yeah. Yeah.

Taylor:

[10:46] You know it’s like, yeah exactly… I had the same thing. I was like well hope nothing terribly you know… goes wrong. It’s fine. It’s fine.

Maggie:

[10:48] Yeah. Well I got the, I got the home warranty which helped when the AC broke two days later so…

Jewels:[11:00] Welcome to Texas.

Taylor:

[11:00] Yeah it’s, it’s a lot and I didn’t fully understand how interest worked when I bought a house. I was like yeah 375, that’s all I have to pay. And then I was like oh no, my mortgage is a lot more than just me… just me paying off my house. They want a lot of money in interest. Like it doesn’t seem like a lot when you’re looking at low numbers but when it’s such a huge amount that you owe.

Maggie:

[11:25] Over 30 years, yeah.

Taylor:

[11:26] Yeah you’re like Oh no I’m actually spending like $500,000 on this house which hopefully will be worth more than that. Maybe one day I sell it. Yeah hopefully.

Jewels:

[11:33] By 30 years?

Taylor:[11:26] Yeah hopefully.

Maggie:

[11:33] Yeah you can also like pay off sooner at some point if you get extra money.

Taylor:

[11:39] Yeah if I like, I don’t know when the lottery or maybe I get a bunch of money from shorting Warren Buffett’s companies. Yeah that’s my plan.

Becca:

[11:50] So we just have to learn options trading. We have to do it.

Taylor:

[11:55] Let’s do it. Let’s do it this week while we’re watching Jigsaw.

Becca:

[11:59] Okay. Yeah. Well, we have to finish the Saw universe and then we can get into options trading, which is the dooshiest thing I’ve ever said.

Maggie:

[12:17] It was a little hard to hear for sure.

Becca:

[12:17] The new Saw movie’s coming out and we got to finish the franchise until we get to it.

Maggie:

[12:24] Uh huh.

Becca:

[12:24] We’re going to see it opening weekend like psychopaths. Julie, do you want to talk about your investing journey and how you are invested now? Because you haven’t always been 99.999% invested in crypto.

Maggie:

[12:35] Well technically she’s not now either, she does have real estate and businesses.

Becca:

[12:39] Does have real estate.

Jewels:

[12:44] Well, as far as investments go. Yeah, I would say that our primary investment for the last six years has been our house, our primary residence, which is also a liability, but sometime last year the equity outpaced our debt in it. So it became an investment then, and our actual investments in things up until that point still would have largely been crypto just a much, much smaller total portfolio than our current, which is kind of astronomical right now.

Becca:

[13:12] Which is amazing!

Maggie:

[13:14] So what you mentioned, are you going to buy the house down the street for us?

Jewels:

[13:18] Hopefully, hopefully, maybe a bigger one. We’ll see.

Taylor:

[13:22] Where were you two years ago? Like massively in debt, trying to pay off your taxes for five years.

Jewels:

[13:22] Well, we’re still waiting on our house to get appraised so we can do our re-fi so we can pay the taxes. But yes, yes.

Taylor:

[13:29] I’m just saying like, that is truly insane, truly insane how much you can get done in like two years, one year.

Jewels:

[13:36] Really insane. It’s mind boggling how much… it’s crazy. Maybe next year we’ll have a million bucks. That’ll be great.

Becca:

[13:47] Fingers crossed for all of us.

Taylor:

[13:48] I’d like to think that.

Maggie:

[13:49] That is like my 10 year goal Julie.

Taylor:

[13:52] Dude, one of my friends and he doesn’t know shit, but he was, we were talking about crypto and he was saying that he read this article that said like anyone that invests in crypto right now is probably going to be a millionaire in 20 years. Like if you even put in a little bit of money, you’re going to make a lot of money as long as you just keep doing it. I don’t know if that’s true, I don’t know a source, but he seems to be convinced. Also on our company meeting today crypto came up, it’s like a fucking thing y’all. Literally the 1st 10 minutes of our company wide meeting with everybody on the call, the head of the company was talking about cryptocurrency. He was like, I don’t know shit about cryptocurrency, but I just bought a bunch this weekend because fuck it.

Jewels:

[14:34] What did he buy though? Did he buy Dogecoin because of Saturday Night Live?

Maggie:

[14:40] All right. I have a, I have a real financial question for you guys.

Jewels:

[14:34] Tell us about your risk tolerance Maggie, It sounds like maybe…

Maggie:

[14:51] I base it purely on my friends’ opinions. Okay. Um no, I think, I think I’ve actually gotten riskier over time. Um, when I first started investing it was just because, you know, like, my parents were like, you should have a 401K. And I was like, I don’t know, it seems like someone… probably I’m fucking not going to live that long, but whatever. And so I put like the bare minimum into 401K, like basically the company match and did that for a little while. Um, and that actually, that money has been fun to watch grow over time because I, during that time was just very half assedly, like just put a little bit and and now it’s actually kind of a substantial amount of money,15 years later, which is kind of cool. But anyway, so started out like that, and then um it was until I took some time off and like tried to find myself, and learned about like early retirement that I was like oh I should I should start investing in lots of different things. And that’s when I started doing that, and then just the more I read, the more I was like kind of like what Becca was saying, just like, oh I should put some in real estate and I should put some in this and I should put some in that. But then it’s hard when you’re watching your like 2% of your portfolio that’s in crypto jump up 100% in a week and you’re like index funds just kind of, beautifully, but slowly growing, it’s like a very different thing, and then you get this like, oh I should move everything in the crypto because it’s like killing it and they’re like, oh but I could lose all my money and so I do with that a little bit. Um, right now I’m sort of feeling a little more risky because I like have some job security so like I can take a little more risk and I have paid off my debt. Like when I had a lot of debt, it was like I don’t want to be risky with my money because every dollar I need to get out of debt, but now that I’m out of debt, it’s more like, oh I have some money that I can play with a little bit more.

Becca:

[16:50] Mhm.

Maggie:

[16:51] I have the feeling that over time I’ll probably become even less risky than I am now just because I do want to retire early and I want everything to be automatic and not think about it.

Jewels:

[17:02] I do think it’s a really important point that risk can be so relative to the rest of your living situation and that if you have your income lockeded down or you have an emergency fund, and you’re not trying to hit some sort of near term retirement date. That can open you up where you’re like, OK, I’m a lot more comfortable risking this for the potential that it moves that retirement date forward and knowing that if things go sideways, I can recover and that it’s not going to impact my day to day life now, because this is not money that I need for my day to day life now.

Maggie:

[17:34] Yeah, like if I was retired, I would not be risky at all because it’s like if I lose that money, I might never get it back. Which would be scary.

Becca:

[17:41] Yeah, it’s interesting because like in the book ‘Invested’, we’ve plugged 16 times this episode, but it’s what really spelled it out for me that holding onto your money is not unrisky. It’s a guaranteed loss of money. Like it’s beyond risky, it’s a guaranteed loss. No question about it. There’s no, like if you’re exclusively saving like I did, you will only lose value in your dollar. So it’s not about is investing risky, it’s about investing is your only opportunity to not actively lose money.

Maggie:

[18:18] But then do you want to invest in like bonds or index funds or cryptocurrency or real estate or…

Taylor:

[18:25] And there is some… people are very uh, immediate benefits. Like it’s immediate satisfaction, immediate rewards, it’s biologically programmed into us to be that way. So investing is naturally like, it’s like a long, I mean, I guess for some people is not, but in general, if you want to make like steady money off of it, it’s like a long, the long con or whatever.

Becca:

[18:49] It’s a long time. It fucking is.

Taylor:

[18:50] It’s a long con. You know, like you gotta, you gotta play the game long term to really see like big benefits unless you’re doing something like meme stocks or like crypto where you just, you’re trying to like time it out, which is so hard to do.

Becca:

[18:57] Mhm.

Taylor:

[19:04] But, and you always hear those stories of people that have made like millions of dollars overnight over this stuff.

Jewels:

[19:11] And then the next day they lose millions of dollars or more over it.

Becca:

[19:14] Yeah, because you get, yeah.

Taylor:

[19:16] Yeah. Yeah.

Maggie:

[19:17] Yeah. For every story about someone making it big there’s a story about someone losing their entire life savings.

Taylor:

[19:20] Right. For sure. Well, there’s no for every one story, there’s someone making a bid. There’s 100 people that haven’t told their stories that have lost all their money.

Becca:

[19:21] Yeah, that’s right.

Taylor:

[19:30] So it’s… and it’s scary. It is a scary thing. Um, and if if you’re, yeah, I would think if you’re really risk adverse, do the bare minimum and put it in index funds, get a 401K. Go and match it to the full and get an HSA. And you’re good.

Becca:

[19:40] Yeah. If you do nothing else just buy your US fucking treasury bonds um, though we’ll see what happens to those I guess. Um with some changes that are likely to come with interest rates from the Fed here soon. But still, yeah, like that, it’s better than fucking sitting in your savings account. I think mine has been sitting in my Money Market Account for the last 10 years, making .02% or something just absolutely beyond negligible, $12 a year or something. Um yeah, this group of ladies is definitely what affected me investing and getting over that decade long fear of like, releasing even a tiny grip on my… because I still have 50% of my portfolios in cash, like I am by no means a fully evolved woman um, or investor.

Maggie:

[20:41] But you are very strongly saying like the things you’re like, you, you truly believe that if you have cash, you’re losing money, but you still have cash.

Becca:

[20:51] I still have cash, fucking Warren Buffet style. I’m no better than that man. No, it’s because I um…

Taylor:

[20:58] Little better than him.

Becca:

[21:00] Oh, it’s slightly better. Um I think I’ve got something around like 30% is in index funds, like active or general investing, non retirement, and then probably 15% is retirement money, and then like another 5% is split between crypto and fun active investing, and then whatever is left is in cash. But I do want to… mine, and I feel like I’m right in the middle when it comes to risk, because I so see the value of just the slow burn index funds and it’s what I evangelized to everyone, but then I’m so enticed by the quick buck. Oh my God, I like, I feel like I’m just a moth to a flame. And it’s so fun.

Taylor:

[21:45] And it’s fun. Active investing is fun.

Becca:

[21:48] Though, now with crypto like public or active investing is getting less fun because it’s just going down and it fucking pisses me off, because like, with public, I’ll find a company that’s great. Like I believe in the Hims and Hers company. I think it’s really fucking good. It provides accessible products to people and it like destigmatizes all the natural things that come with the human body and I believe in it and I have lost so much money on that stock, I lost so much money. Um anyway, so yeah, I’m like right in the middle and then when it comes to real estate, I’m the one of us who doesn’t own any real estate and it kills me because I really want to own in Austin, this like super hot market. But then the equally big piece of me is like, what the fuck are you doing? You don’t make enough money to own in this hot market. Like this is a sure fire way to lose all your fucking money is to like solo buy a house when you don’t, when you’re a massage therapist.

Maggie:

[22:49] Well, you got a boyfriend now.

Becca:

[22:52] I do have a boyfriend who’s incredible. But even between the two of us, we are not high earners by any means. Um, so, and I don’t, I’m, I don’t feel comfortable putting that burden on him.

Maggie:

[23:00] It’s a yeah, maybe later down the line relationship issue.

Becca:

[23:08] Yeah. Yeah. I mean we are two months in,

Taylor:

[23:13] Maybe like in three or 4 months revisit.

Becca:

[23:18] So we’re going to talk in a couple of weeks. No, but even like, I am very, very confident in this relationship, but even still, it’s like money changes everything. And um, especially considering I’ve been looking at houses and looking at owning for over a year, um, I wouldn’t be like, hey, now that we’re dating a couple weeks, hop on in, get in here with me, mix it up, we have combined finances now hope that’s fine. I want to be able to get it by myself. But anyways, I’m just very afraid. I’m a big weenie when it comes to real estate, even though it seems like the most guaranteed way to make money in this city. I’m like horrified, I’m terrified of it.

Taylor:

[23:55] Because there’s just so much to know, that’s why there’s like 20 different experts on different aspects of real estate and like owning real estate, there’s just so much more than one person could possibly know.

Becca:

[23:59] Right? Yeah. And I don’t feel like I get it still like, I’ll be completely honest with you, like if there’s interest that you’re paying, how much money do you have to make on a sale for you to actually make money off a house in Austin? And then if you were to want to continue to live in Austin, could you use that money to actually buy a house? Because most of that would still be your debt that you’re paying off. So you really only have a little bit of money to go towards a new house. Do you know what I’m saying? I don’t get it, I don’t get the math. And it scares me very much.

Taylor:

[24:39] Your house would have to be worth a lot more than what you bought it for plus interest for you to make money off of it. So like if I.. that’s my understanding so like if I…

Maggie:

[24:49] No, not plus interest because the interest happens like as you go.

Taylor:

[24:53] Right, that’s what I mean though, is the total, I mean the total amount you’ve spent. So like say, say.. so like my house 375, say by the time I’m done paying interest it’s what? 600,000?

Jewels:

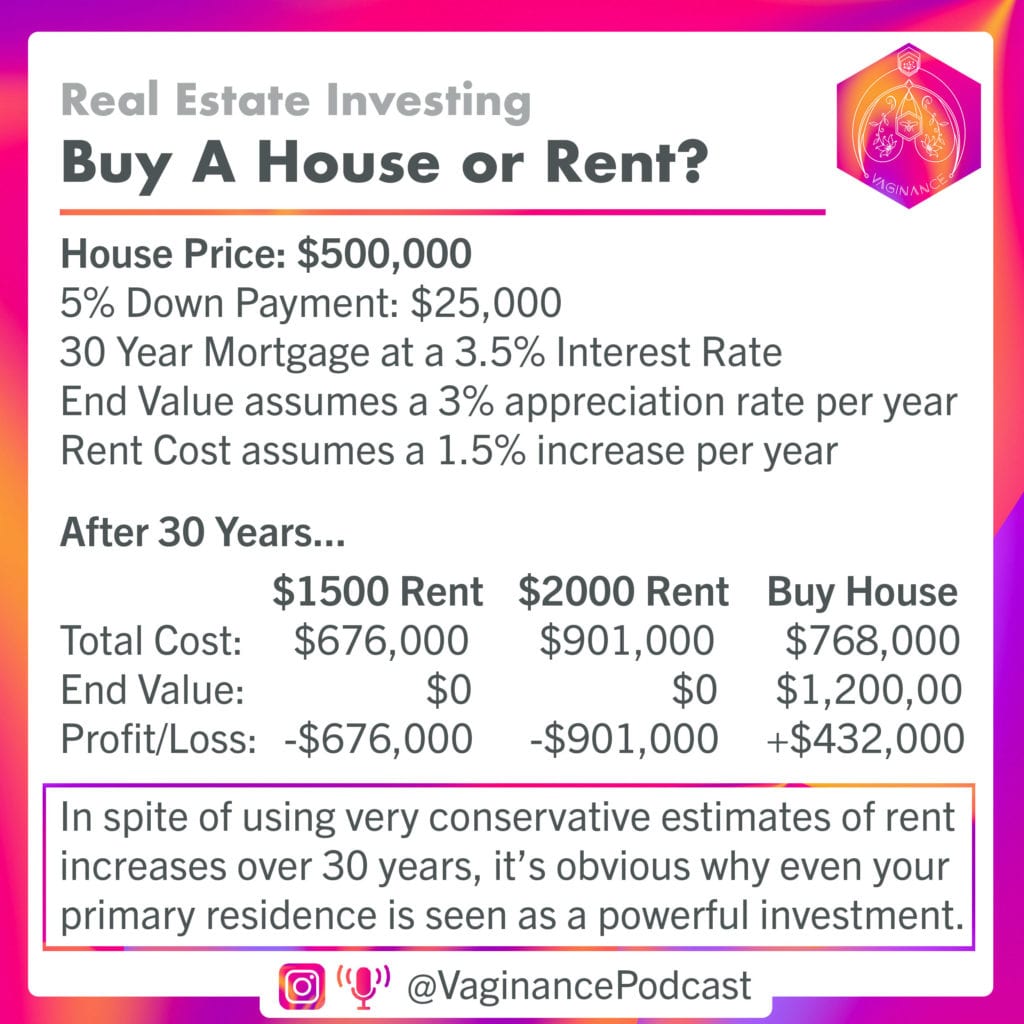

[25:04] So a few things on this. Big difference between primary residents, like if you are living there, it’s a liability because if you’re not making enough money to cover it, then you will lose your ass on it. If it’s an investment property that other people are paying off for you, then it’s an investment. It might be like a neutral asset because the cash flow coming in just covers your monthly expenses or your monthly expenses plus a little bit for things that might come up like a hot water heater and stuff like that. But it’s also really tricky to look at the math with real estate because when you’re doing the math on a place that you live, it’s important to take into consideration if you’re assessing that as an investment, but not also including how much you’d be paying to live somewhere else, and comparing that to other investments.

Maggie:

[25:52] Yeah, so like if I was paying if I was paying $1500 in rent versus $1500 in mortgage, that mortgage includes my um…

Jewels:

[25:52] That’s not making sense.

Taylor:[25:53] We’re losing you.

Maggie:

[26:04] Principle, my interest in insurance and other stuff. So at least I don’t know, maybe $500 of that is going to the principle of the house. So in rent you’re losing $1500. When you’re paying a $1500 mortgage, 500 of that is going pay off something that you own. So it’s like $1000 rent instead of $1500 right? One way to think about it.

Jewels:

[26:30] Right, or to get the same level of investment, you’d have to be paying your $1500 in rent and somewhere on the side investing $500 on something that has the same return as a real estate investment.

Becca:

[26:42] It’s just, I don’t understand… I like really can’t wrap my head around it, I really can’t.

Taylor:

[26:46] Let’s try… do you want to use my house as an example and do the math? Okay.

Jewels:

[26:46] That’s way more involved than you think it is.

Taylor:

[26:53] Let’s simplify though, okay. So say my interest is 3.4%. So…

Jewels:

[26:56] Mortgage interest is front loaded.

Taylor:

[27:00] And I know it becomes complicated because as you, as you pay it off it gets, it becomes less interest that you’re paying, so you’re paying a lot of interest up front because the amount you owe is so much. But as the years go on, you pay less and less interest.

Becca:

[27:12] So assuming, I know you put 10% down, but assuming 0% down because you’re a veteran, um you owe the first month.

Jewels:

[27:15] Okay. So, so doing it like month to month because it changes every month is actually a really hard way to conceptualize it because mortgage math is complicated. But the important thing is you are looking at a 3.4% interest rate, that’s what it’s costing you because this is an investment you’re making, you have to pay the interest Aas opposed to when you’re investing in something. Even like an index fund in the stock market that has returns of 8%, you’d be better off leveraging and getting a mortgage at 3.4% and letting someone else pay that off for you or paying it off yourself because it’s saving you from putting all your cash in that investment. So if it frees up cash that you can put into an investment that makes more money, you come out ahead.

Becca:

[28:03] Yeah, so the fee that you paid to hold onto the house….

Jewels:

[28:09] Is really low compared to the return you get from investing that cash somewhere else. That’s why it makes sense to get a mortgage in some cases, but especially if someone, if it’s an investment property with renters and someone else is paying it off for you, because you get to invest so much more money early in your life that you couldn’t possibly invest otherwise because we don’t have $500,000 or $200,000.

Becca:

[28:35] Yeah yeah that’s a good…

Taylor:

[28:39] It does blow my mind how much money you could save, though. If you had cash to buy a house, like not having to pay a bank interest on a house.

Jewels:

[28:44] You would still come out ahead getting a mortgage and taking that cash and putting it in something else.

Taylor:

[28:54] Really?

Maggie:

[28:55] Yeah. Because like for example, in the index funds our rate of return is say 7%. Which is you know, generally higher than…

Taylor:

[29:02] SWhich is higher than the 3.4 or whatever.

Maggie:

[29:07] Yeah. And you’re paying a 3.4% on your house. So if you put that money into index funds instead of a house, you’re making 3% more than you would.

Taylor:

[29:10] That’s true.

Jewels:

[29:19] You’re making enough to pay off the interest on your house and that much again in cash for yourself on return.

Taylor:

[29:23] Yeah.

Maggie:

[29:23] Plus some.

Taylor:

[29:26] So if I win the lottery tomorrow, I should not pay off the mortgage on my house, I should…

Maggie:

[29:28] You should buy 10 more houses.

Jewels:

[29:28] Yes. And put aside an emergency fund so that you’re never at risk of losing those investments if your income drops off for some reason. So that’s sort of my philosophy and I’m probably have to cut a lot of whatever I said earlier that I don’t even remember about my risk tolerance. And so, our investments obviously, highly speculative crypto investment but our actual long term investment goals are mostly around real estate, 1 because we get crazy tax benefits for real estate investing because the tax code’s written for it and then also because the ability to leverage your investment but have cash coming in to cover it. So it’s probably the least risky high leverage investment option available to normal people So we can invest 25,000 up front in something and then by the time it’s paid off, that asset is worth half a million dollars.

Maggie:

[30:27] Yeah, if you have tenants paying the whole mortgage for you, then your $25,000 investment just became $500,000.

Jewels:

[30:30] Right, it’s like you’re making the investment that opens the door and someone else is actually paying the investment for you.

Becca:

[30:39] I do find that very attractive.

Taylor:

[30:41] That makes me wonder… so like with my house, I really don’t want to ever sell my house if I don’t, if I can avoid it, I love it so much, but I’m trying to figure out how I can make money off of it as values go up, and like I know Zach has mentioned, you know, you could always like build a property in the back, but like how would I make money if I’m, if I’m taking out a construction loan of like, you know, say $250,000 to build a house in the back, how am I ever going to make money to pay that off? Plus the mortgage of the house in the back if I don’t want to sell it?

Jewels:

[31:16] Okay. So the value at the end of your construction, if you’re doing your development project well should come out substantially higher than the cost you had to take out to build it. So if it costs you $250,000 to build in the back but it ends up being a $400,000 or $450,000 back house, value wise.

Maggie:

[31:39] Like HDTV where they’re like, we did a $10,000 bathroom remodel and added $40,000 of value to the house.

Jewels:

[31:43] Exactly. Exactly.

Taylor:

[31:47] Yeah, but how am I actually seeing that money?

Jewels:

[31:47] So. Okay. Okay, so here’s how here’s how it works. You can cash out refi down to 20%.

Taylor:

[31:52] I don’t even know what that means, cash out refi?

Jewels:

[31:56] So you do a refinance where they redo your mortgage, you like get a new mortgage, they pay off your old one and when you do that you can cash out any equity you have down to 20% of the value. Okay? So if the bank, the bank has a mortgage against your house, what they’re doing is they’re saying ‘We’ll give you enough money that we know if you default on this, we as the bank can sell your house and recoup our loss. So if they say, ‘If we were to sell your property, it’s worth $800,000.’

Taylor:

[32:29] Mm. My brain is exploding right now.

Jewels:

[32:30] So you have to keep 20%, let’s do $1 million. Let’s say your new property value is a million bucks.

Taylor:

[32:35] Hell yeah.

Maggie:

[32:38] That’s much easier, thanks Julie.

Jewels:

[32:39] Then all you have to do is keep 20% equity in there, so $200,000, right? You cannot cash out the last $200,000 of that value, so you going leave that in there.

Taylor:

[32:53] Leave it where?

Maggie:

[32:49] In the bank.

Taylor:

[32:53] OK. Not buried in small bags under my property, OK.

Jewels:

[32:57] In the bank. In the bank. Yes. Yes. And then let’s say at this point, your costs were $500,000 between what’s left on your old mortgage and the construction costs. So they’re going to pay that off for you. So now you’re at $700,000. That leaves you $300,000 worth of cash that you have in equity in the property that the bank will say ‘OK, we’ll let you take out a mortgage against that and you, we’ll give you that cash, in cash to do what you want it.

Taylor:

[33:32] But I have to pay interest on that cash, right?

Jewels:

[33:32] Y,es but you’re paying interest let’s say 3.5% and you can take that $300,000 and invest in something that makes even a measly 7%, you’re double the return.

Taylor:

[33:40] Oh my god. That’s genius. So I would just rent out the back house to cover the mortgage and take that extra money and invest in something else to make more of a return to pay it off.

Jewels:

[33:48] Yes.

Taylor:

[33:57] Plus I would get to keep some, like 3% of whatever I made. Can you help? Can Zach help me, can ya’ll help me do this?

Jewels:

[33:59] Yes. And also I’ll put some handy math breakdowns in the show notes that are much easier to read.

Maggie:[34:12] Let’s re-record all of the math part.

Taylor:

[34:07] I mean, I need to get I need to get my life together before this happens. But um, that is, I would love to not have to sell my house or any part of my property if I can.. like even, even building…

Jewels:

[34:19] Don’t sell your house. We’re not going to let you, your realtor won’t sell it or else we’re buying in, so…

Taylor:

[34:29] Yeah , even if I built a back house I would love to be able to hold on to the property because I do really love my house.

Becca:

[34:37] Well, I feel like we answered a lot of questions about real estate and that I should just I should buy a fucking house, even though it seems like the scariest thing in the entire world.

Taylor:

[34:41] Yeah, and just don’t live in it you know like yeah just…

Becca:

[34:50] Oh, I’m not… I can’t afford a house that I want to live in.

Taylor:

[34:53] Yeah, just buy it and rent it out or are… there options to buy like, I mean, this is probably even more expensive than buying a house, but there are options to buy like studios, or like smaller business spaces, you could rent out. I don’t know if that’s like… like commercial real estate, but like on a small scale, I don’t know.

Jewels:

[35:09] You can buy commercial real estate, but again, in spite of the impact of the pandemic on commercial real estate um, globally, in Austin, commercial real estate is still really crazy hot.

Becca:

[35:24] Very hot.

Taylor:

[35:25] I was gonna say, a last ditch effort if you can’t afford any of that and that’s just for like general, anyone listening that wants to invest in real estate but can’t afford a house or a, you know, any kind of real estate property. You can always invest in real estate ETFs, they’re hot, y’all.

Becca:

[35:41] What’s the things you… REITs? What are those?

Taylor:

[35:43] REITs. Yeah, it’s basically like a real estate index fund essentially. It’s like a bunch of real estate properties that you can put a little bit of money into and it kind of spreads your money over the real estate market.

Becca:

[35:54] And there’s one that’s like just for New York City, like you can invest in Manhattan.

Taylor:

[35:57] Yeah, all sorts of like really specific stuff. And they on average have a higher return rate than traditional index funds and ETFs for other types of areas. So, that’s just from what I’ve read. That’s my understanding and I’ve, I am putting my mouth… my money where my mouth is.

Jewels:

[36:21] Putting your mouth where your money is?

Taylor:

[36:25] What’s the… putting my mouth where my foot is, in my money. Um I have invested in REITs, I have invested in it. So I think it’s a great option for people that can’t necessarily afford to put, you know, get a loan for $300,000. Just put in 300 bucks into a real estate fund that you really like.

Becca:

[36:43] Yeah. And you can get these, like, literally on your brokerage account if you’ve got a public or Robin Hood or a TD Ameritrade, whatever you can get.

Taylor:

[36:47] Yeah. Which I kind of want to put more money into it now that COVID’s… now that we’re opening up. COVID’s not over by the way, we have like five new strains but whatever. It’s fine. Yeah.

Becca:

[36:56] Well, I’m officially in denial for the record. Yeah, I still wear my mask everywhere.

Taylor:

[37:01] You and everybody else. Yeah but we’ll see.

Jewels:

[37:08] I think for me, the biggest thing… I’m really comfortable with risk, but also having the level of security financially that I have now that we didn’t have for a long time, makes me really not want to let that go. And so even though I’m very interested in speculative crypto trading that’s largely still based around index and portfolio fundamentals.

Becca:

[37:33] Mhm.

Jewels:

[37:34] Um, so I’m not really picking individual cryptocurrencies, like we’re indexing them and taking the profits and rolling them into other ones. And then for real estate, my biggest thing is mitigating the risks inherent in leveraged real estate. So every time we buy a property, I’ve been talking with Zach about this and I want to have basically an emergency fund set aside per house that’s a certain amount of money that covers say three months of the mortgage or six months of the mortgage or maybe even a year of the mortgage. So maybe like the first property we have a larger emergency fund that covers a year. And then when we get another one, maybe we have enough to cover both of the places for six months each because the chance of both being vacant at the same time is a lot lower. Or if the AC blows up or that type of thing. So my biggest thing for mitigating the risk is having enough cash to buy into the property and still having cash left over to have that emergency fund. Because the real point at which people lose their ass and leverage real estate is when they are keeping their finances like so close to the edge that one month of vacancy or two months of vacancy means they’re, that they can’t afford it. But if I have six months worth of vacancy already covered in the account, I’m not worried about it. Um, so yeah I think you can do riskier investments if you’re really focused on mitigating the risks because they’re known these aren’t new risks, like you can see what happened in 2008 with people and who was successful and who wasn’t. And it’s pretty easy to then make a plan to put yourself in the people who’d be successful under those types of really extreme circumstances.

Taylor:

[39:14] Yeah, I am. I do feel like I’m at that point where I’m a little, I’m not as comfortable as I want to be with how much money I have saved for, like to float the mortgage for a certain amount of time. I think I could float it like 2-3 months unpaid if like, you know like that’s alone. Like if Joey disappeared, I had no roommates, nothing, I don’t think that’s going to happen, but like worst case if it does, it would be like two months, which is not enough. Um, but I’ve been like auto, like every month I have a certain amount of money like auto transfer to my savings where like that all lives. Um and that’s just like cash, it’s not invested. But it’s one of those things where I feel like I need more of a buffer, but I also need to make more money to have more of a buffer.

Becca:

[40:08] It’s funny, I like think a lot about how much, well this is actually a question that ‘Your Money or Your Life’ prompts about money mindset and it’s like how much money is enough money to you? And that number is, I’ve just realised for myself unachievable because my enough changes constantly. Like I think OK once I hit this net worth I’ll feel comfortable buying a home and then I’ll hit it and surpass it and be like, whoa. No way. And so, like what is enough? Well it’s just like, I mean I feel like we have this conversation sometimes like how much weight do you have to lose for it to be enough for you to feel confident in what X, or you know like, like what are these numbers? What are these arbitrary things that we’re imagining?

Taylor:

[40:53] Right. Yeah.

Becca:

[40:53] Like how, what do I need for me to take myself seriously? Like what number needs to be in my account? What does my dress size need to be, like, when do I decide that I am valuable?

Taylor:

[41:05] Well, I think the answer is it’s never enough.

Becca:

[41:07] It’s never enough. And that’s why you have to, like because so much of our money is tied to our emotions. Like you have to actually do the fucking math. Like don’t like have a feeling like this number feels like enough because it won’t be when you get there.

Maggie:

[41:23] One life is dynamic, like you were just saying, and as soon as you get there, then you’re in a whole set of new fucking circumstances.

Taylor:

[41:28] Well, it’s like the whole thing we’ve been talking about tonight with like, what’s your risk, like what’s your level of risk you feel comfortable with? It changes hourly for me. Like depending on my mood, like I’ll go through like an afternoon high where I’m like, I’m going to blow all my money on GameStop. And then it’s like, by the evening I’m like, I need to really like, conserve and save and not spend money and then I’m like, on fucking Amazon the next day.

Maggie:

[41:52] Buy and bury some gold.

Taylor:

[41:55] Yeah. Like it’s just, I feel like I’m changing all the time and you’re totally right. Like sometimes I feel super confident at a size 14 or whatever. Then I do at a size six or what, you know, like any size, it doesn’t, it’s never, it’s never going to be enough ever.

Becca:

[42:10] Yeah it’s all very complicated. But I also have the, like because all my free time obviously I fuck around on the internet but like a lot of that time is spent on financial shit. Like I am constantly reading financial shit but we’re talking, we’re not talking high level peer reviewed shit.

We’re talking like deep CD like what’s the next hot thing slash what should I be watching out for? Like forums, and I love it so much or just refreshing my crypto account. But like yeah, I’ll think like OK, um if we break through 3000 on Ethereum and we’re going to go parabolic so I need to put a lot more money in Ethereum and that means we’re getting close to the Altcoin season. So I need to… And then I’ll read like one little thing that’s like guys something that goes up, can’t go up forever, it’s gonna crash. Also SNL, Elon Musk, Dogecoin, meme, crash and so I was like, fuck you’re right, crypto is nothing so I want to pull everything out of crypto and then I want to put it in stocks but then you read about how the stock market is gonna crash.

Taylor:

[43:11] Stock market’s going to crash. I have been… this has been dwelling on me. So this has been weighing on me so much with investing just in the stock market. Part of me is like I feel like I should just sell all of my stocks or at least my, all my dumb meme stocks because it’s all gonna fucking crash soon.

Becca:

[43:25] Every indicator says that the stock market is going to crash, and for fucking Warren Buffett, 150 billion sitting in cash. And the reason he’s doing that is because he wants to buy it when the inevitable crash comes, Berkshire Hathaway is sitting on $60 billion cash because the company wants to buy up shit anyways.

Taylor:

[43:40] They literally want to make money off of you losing money so go fuck yourself, Warren Buffett and fucking Charlie Munger.

Becca:

[43:46] Literally their whole thing, their whole thing is buy fear, sell greed and you’re like buying fear doesn’t make you good, doesn’t make you a good person.

Jewels:

[44:01] Seems immoral.

Taylor:[43:56] You’re just literally taking money from millions and millions of people.

Maggie:

[44:04] So what you’re saying is, I should save some cash for a few months.

Becca:

[44:07] Exactly, but then you can’t hold onto cash. What’s that gonna do?

Taylor:

[44:12] Because you’re… then you’re losing an inch, like in inflation. Like no matter what, you’re just going to fucking lose because the game is rigged.

Jewels:

[44:20] So I’m fully invested in crypto and real estate because people have to live somewhere, that doesn’t go away.

Taylor:

[44:29] That is, yeah you’re right.

Maggie:

[44:29] My good friend Becca is going to pay my mortgage for me.

Taylor:

[44:34] Yeah. Well, she was paying mine for a while and now she’s paying yours so she’s doing her part.

Becca:

[44:41] Look, I’d rather pay y’all’s mortgage than some fucking management. That was actually a huge, and like a huge part of me and Andy deciding where we wanted to live because we’re like, well we could have a bigger space. Uh, and like a maybe a place we want to, like a location that might be a little more convenient for his commute. But we’d be paying all our money to some fucking property management company. And I have loved the past year paying my money to Taylor and like it going to her mortgage. That’s like, it doesn’t feel like I’m throwing I mean, technically for my finances, I know it’s not an investment, but I don’t feel like I’m throwing away money.

Taylor:

[45:14] It’s an investment in our relationship and look at this mug I got you.

Becca:

[45:14] It is, we have a financially based relationship it is paying. But really, it doesn’t feel like I’m throwing away money. It feels like I’m investing in someone I love. Which I am and like, like that, that’s a huge sell of why we wanted to move into Andy’s back…

Maggie:

[45:32] Yeah, well and it’s nice that we’re still all so close to each other.

Taylor:

[45:35] Yeah.

Becca:

[45:35] Yeah. Four blocks. God I love it so much.

Taylor:

[45:38] There’s no price tag on that.

Becca:

[45:41] There’s no price tag on it. Maggie could have charged us anything.

Maggie:

[45:43] Damn it.

Becca:

[45:45] Not really. We don’t make that much money.

Taylor:

[45:50] Yeah. I don’t know. It is a good argument for real estate investing, though, is that it? It probably is a lot more, um, what is it, the word? Like resistant to the stock market changes or like proof, stock market, crash proof? I don’t know. Like if the stock market all plummet real estate will probably go down, but not as much as like the stock market is going down.

Jewels:

[46:18] They’re separate markets, so that the real estate market has its own crash risks. Um, but the fundamentals are quite different than when, like the last the 2008 real estate crash happened, that happened for very specific reasons. It has its own risks and you need to know those risks before you go investing in real estate. But again, a lot of the risks inherent in real estate investment, you can mitigate yourself, whereas you have very little control over mitigating the risks in the stock market and in the companies involved in the stock market, like you don’t have a lot of control,

over the actions they’re taking that can affect their evaluation. But if it’s your own real estate investment, you have the ability to mitigate those risks yourself.

Taylor:

[47:00] So when you say you have more control over it, you mean like where you’re buying and things like that, like you have more control over the actual like location.

Jewels:

[47:00] From the up front… yeah, you do have control over the upfront investment, but that’s also like when you’re picking companies, you have that level of control. But by having an emergency fund to mitigate the risk because your biggest risk with the real estate investment is vacancy rates during some sort of transitional period. So you have to survive that transitional period. But if you know that up front you can stack enough cash to cover that and mitigate 90% of your risk on that investment.

Maggie:

[47:36] And you can also choose like how you improve your house, where you’re putting future value, landscaping, redoing the bathroom, stuff like that. Like those are all choices you can make and how you do it and how nice you want to do it versus not. So it’s kind of fun. I like that aspect of it.

Jewels:

[47:53] Right. Some of the factors in the value of that asset are things you can actually control and add to to increase the value. There’s some that just increases because the market in that area is going up. But like Maggie was saying, a lot of things are you can make the decision to redo the kitchen or redo the bathroom and you can get a lot more value than the cost it took to do it, and that’s in your control. You can’t walk into a big company that you’re invested in and you’re like, I’m gonna change some things around here.

Maggie:

[48:23] Going to redo ya’ll’s bathroom real quick. I love real estate. I do find that’s, what Taylor was saying earlier is that it’s not very accessible for a lot of people is true and even already owning a home, I’m finding it very difficult to, make a second investment just because that down payment money, that you need is so hard to save. It’s hard to have that big chunk of change and not have something else that prioritizes your life first.

Becca:

[48:54] Especially in our city, we have some high costs for our homes. It’s very expensive to live centrally. So if you want to invest centrally, you have to have a fuck ton of money on hand and earn quite a bit of money.

Maggie:

[49:07] Even like traditionally, like $100,000 house, you want to put 20% down. That’s $20,000. That’s a still a really big chunk of change for young people to have. And so it is, I think Taylor is dead on that it is hard to break into real estate. It’s not easy.

Becca:[49:14] Yeah, totally.

Becca:

[49:23] It’s not easy. Cool. Well, is there anything else we feel like we need to cover about investment style, investment vibes?

Jewels:

[49:35] We should talk about those different styles.

Becca:

[49:38] Well, so I think you’re referring to the SRI versus Impact versus… Yeah. So Julie very kindly broke out these kind of different ways that you can approach what you’re investing your money actually. And we talk about this a lot, like how whenever you’re investing your voting with your dollar, so if you want to only invest in tobacco and guns and gambling or whatever, just be mindful that you’re further funding those causes and maybe that’s totally fine with you and that’s fine. Um, but you, it’s naive to assume that you’re working in some sort of vacuum like what you’re putting your money towards is essentially a vote because you’re further funding it. So Julie reminded us of the Social Responsible Investing and what was it? Environmentally responsible investing?

Jewels:

[50:26] Environmental, social and governanc, like ESGs I think they are.

Becca:

[50:29] Yeah. Yeah. So those are essentially, investing in companies that aren’t actively working against the environment, human rights, social causes, but so it, so that means the companies are doing positive things and it means companies that are doing nothing, very neutral. Uh net zero um towards those causes. And then there’s Impact Investing, which is where it’s, you’re exclusively investing in companies that do great or do positive things for those movements and those causes. Um, but excluding the neutral. So I don’t really know much about how… So my Betterment account is Betterment SRI, Socially Responsible Investing, that’s the portfolio.

Maggie:

[51:10] Excluding the neutral.

Becca:

[51:20] But I don’t know much about Impact Investing, and is that something that you can robo invest in? Or is that where you need to consciously… you have to consciously seek that out and put that in yourself.

Jewels:

[51:31] At this point it’s still a lot more active investing or even angel investing. We don’t have access to do VC investing necessarily because we’re not accredited investors. But the rise of the ESG and the SRI funds over the last few years I think is indicating that soon we are going to have more impact investment funds available to us as retail investors. So the ESGs and the SRIs are really the first wave where we can say, I care about these causes and I do not want to invest in, say, a total stock market index fund because I am sort of unintentionally also funding things that go against my own values. But by investing in the ESGs or the SRIs I can at least weed out the worst players and put my money in companies that at least aren’t doing harm and some of them may be quite positive. But in a few years hopefully we’ll have more options to pick like, no, I want to put my money behind companies that are both a good financial investment and are actually actively working towards these positive endeavors that are going to impact the environment or social change or any of the things that sort of match up with my own value set.

Becca:

[52:44] Yeah, I think we’re moving that, well and they’re making… fucking it’s about, it’s driving me crazy. There’s a company that started, where you can as an individual contribute to essentially act as a VC, as a venture capitalist without being an accredited investor. And it’s more like crowdfunding sort of situation where you’re pitching in money towards something. It’s not WeFunder, but I assume it’s the same thing. Um, and it gives non accredited investors… and what that means is you just make less than a million dollars, essentially, and you can invest in startups that you really care about and you can invest in companies that are actively working towards a positive good that you care about. That is not currently very accessible to us, especially from a startup perspective. So I think that shift is coming very very very, very quickly.

Jewels:

[53:36] I agree. And I know we throw around the terms index investing and active investing and Taylor as being very interested in value investing. Um, and certain companies we’ve mentioned who might be more growth investment. Shall we jump into explaining those briefly as well?

Taylor:

[53:54] Yeah, so index investing, you’re investing in index funds that track the overall market. So, um they usually are slower growing, but they have a really good consistent growth over time. It’s looking at the market as a whole or like it could be looking into like the top.

Jewels:

[54:18] Right, a certain section of the market or the entire market. And so, your returns will match the average of that section of the market, essentially.

Taylor:

[54:22] Yep. Exactly, so if the market’s doing really well and the stocks are all up, you’re going to be making money. But it looks at like businesses across the board, so like hundreds or thousands of businesses are in an index.

Jewels:

[54:32] And your big, your big benefits there are that often these can be quite low cost and require very little involvement or market knowledge.

Taylor:

[54:40] Exactly, and it gives you access to all these companies at lower risk. Yeah, and a lot of investment guys are, most, all of them are huge, huge fans of index funds and always recommend it.Active investing is taking more risk where you’re kind of creating your own portfolio of businesses that you want to put your money towards, which could be higher risk in general because then you’re betting that certain companies are going to do really well and they don’t always do really well. So then you have to learn how to evaluate a company which is what we talked about with invested – deciding whether a company is worth it or not. So, like Becca really loves to like find companies she really believes in or likes or just going new and invest in those, that’s like active investing when you’re like making those active decisions about certain companies. And yeah and then in value investing is like an addition to that where you can pick certain companies that you really believe in and want to support. And you know obviously you should do your research on them, but you can also pick index funds that you really believe in or want to support or ETFs that you really believe in and want to support. Like one I invested in recently was an index fund for just companies that have really good diversity policies. So like companies that like will, are really like have like the best diversity programs and um hiring practices like that’s a fucking index fund that you can invest it.

Becca:

[56:15] Yeah. It’s so cool.

Taylor:

[56:15] It’s crazy. There’s like there’s literally everything that you can imagine. It’s fun. It’s like, ooh I want to invest in like Waterworld and Excellence which you shouldn’t do. But um, yeah I don’t know. There’s probably like a museum index fund or something.

Becca:

[56:35] I know, like the more I dove into value investing the more it kind of fucks with me because the idea of value investing is yeah, you research a company and you actually use math to establish its value rather than use your gut like I like to prefer to do. Um, but it’s more than that, whenever most value investors consider value investing, investing in something when its price is lower than its value. So you’re buying something at what you believe based off of evidence to be under the value of that asset.

Um so that could be…

Maggie:

[57:10] That was the original dude who was super into GameStop did right? Where he was like, yeah, deep fucking value. He was like, I think this stock or this company has a lot of value and people aren’t recognizing it.

Becca:

[57:13] Yes. Exactly. So that’s what value investing is. It’s not just evaluating how much a company is worth and then establishing its stock price. It’s attempting to buy it under its value so that you will make money. Well, so why that fucks with my head is a lot of reasons. A.), we’re in a very bullish market and nothing feels like it’s at the appropriate value, certainly not under it. But then bringing it back down to real estate, actually Julie sent us a Tiktok video that really got my fucking head. The guy with the apple where…oh my God, it really fucked with me.

Maggie:

[57:59] I sent that to so many people.

Becca:

[58:02] Because there was that line where it’s, it’s just this little skit where this guy is talking about real estate right now and you’re selling an ad.. paralleling it was selling an apple and it immediately, whatever, it doesn’t matter. Um, but there’s a point where he’s like, okay, the apple, we’ve got a starting bid at this and the guy was like, wait, is it even worth that? And he’s like, it doesn’t matter.

Maggie:

[58:26] The guy’s like, I don’t know.

Becca:

[58:29] And that’s how I’m looking at real estate, I was like wait is this house worth this? And obviously if you’re looking at just the structure of the home, no it’s not, it’s a tear down shed. It’s very upsetting that you have to pay half a million dollars for it. But the value lies in its you know, location etc. Anyways, all that to say value investing really fucks with you because it involves math and involves a knowledge of your market, human behavior.

Maggie:

[58:48] Involves human behavior.

Taylor:

[58:55] It’s psychology and it involves you are betting that other people are sharing the same delusion that you are, that it’s worth a certain amount. Because money is just a delusion that we all share. Believe in, it means nothing. It’s just dead trees and ones and zeros.

Jewels:

[59:13] This is the 3rd most common thing Taylor says on the podcast.

Taylor:

[59:15] Yeah, it means nothing.

Maggie:

[59:16] I love it. I love it when Taylor does this though, because I always feel like I’m the doomsday person and it’s really comforting and calming for me personally, to hear someone else doing the doomsday talking. Burn your fucking money.

Becca:

[59:35] Cash is trash guys.

Taylor:

[59:51] Cash is trash, that’s so funny.

Becca:

[59:52] See if you were on more crypto forums, that would be a more common statement.

Jewels:

[59:52] Wouldn’t have triggered that.

Becca:

[1:00:01] Anyway, so that’s value investing.

Jewels:

[1:00:05] Okay. So one of the more interesting things I think for starting to just gain awareness of potential value investing opportunities. If you’re not comfortable doing the math and assessing the value versus the current market price, you can look for another type of value investment which is,

you can have a company that is doing well and on a standard trajectory and then has something happened that changes perception about the company. So for example, they could have a PR scandal right, that temporarily causes the price to drop. But it’s something that you believe is recoverable. So like they can kick off the ceo or whatever who had some personal scandal that has temporarily affected that company. But you expect that the actual underlying value of the product or service will bring the price, the stock price back up. So buying in when there is like a PR scandal, as long as it’s not something that actually affects the company. That’s another like opportunity for value investing because it’s a very obvious discount because the price was this yesterday and it’s suddenly dropped, but for a reason that’s not really related to what the company does.

Becca:

[1:01:17] Man, cracked me up when like a couple weeks ago, Biden’s hike on capital, short term capital gains tax was leaked. Um and Grant… OK, so this is only relevant for people who make over $1 million. So most of our listeners, this is not even relevant to you. So please don’t internalize it.

Taylor:

[1:01:37] No, I bet like Elon Musk probably listens to us. Right?

Becca:

[1:01:39] Well, okay. Elon, not you buddy. Sorry. Not to be insensitive.

Taylor:

[1:01:42] Mr Musk.

Becca:

[1:01:46] Yeah, so that, I saw it, like I was…

Taylor:

[1:01:48] So that, sorry, real quick. What if Elon fans were called musketeers?

Becca:

[1:01:55] Oh my god. Why aren’t they?

Jewels:

[1:01:57] Maybe they are.

Becca:

[1:01:58] Surely they must be… hey musketeers, write in, tell us about… That’s crazy. That’s perfect.

Taylor:

[1:02:00] It’s perfect. I’m sorry. Yeah, I’m going to look this up. That’s got to be a thing.

Becca:

[1:02:05] That’s, no, it’s like weirdly perfect. Like why haven’t we heard that yet? Everyone who invests in Dogecoin you’re a fucking musketeer. Just so you know.

Jewels:

[1:02:10] I feel like they would self ascribe as Elonians or something. You know, it sounds very martian, extraterrestrial society weird.

Taylor:

[1:02:19] Quora. Would Elon Musk fans be called musketeers? Someone has already asked this question.

Becca:

[1:02:25] That’s a good question. That’s why they’ve asked it.

Taylor:

[1:02:34] Anyway, go on.

Becca:

[1:02:36] I don’t remember what I was talking about. I couldn’t even give you a bit of an idea.

Jewels:

[1:02:39] The price hike. When the price hike happened.

Becca:

[1:02:42] Oh, so yeah, when his capital, short term capital gains tax hike increase, it’s like for people who make over $1 million, it’s currently at 39%. It leaked that he’s thinking of raising it to 43%. Very sexy stuff. When that leaked, I, because I’m obsessive about my investments, my small investments, my big ones I never look at, but my small investments, I’m very intense about and I was watching my public account, and I just saw everything beep at 12:05 PM that day – just dove and I was like why is everything diving at the exact same time? What the fuck is happening? And I was looking everywhere. And then of course I find out that’s what happened. Anyways, all that to say is that caused this big discount in tech and growth stocks. Even though we know that these millionaires are going to buy back in, they’re not… even if this tax hike goes through, they’re not going to just stop trading, that’s not going to happen. They’re not going to pour their money into bonds, which is what I think theoretically they’re saying is the better strategy for these people. That’s not going to happen. There’s no way that they can accept a 6% increase after like thirsting on 12% increases or whatever. Anyways, all that to say is it shouldn’t scare you when things like that happen because it doesn’t affect the actual quality of the company, the value of the company. It’s just some weird thing that’s happening that you have to kind of wait through or buy into.

Taylor:

[1:04:08] Why is he increasing the capital gains tax?

Becca:

[1:04:11] So that people who have more money have to pay more money whenever they make short term capital gains.

Taylor:

[1:04:18] Yeah. But people that have so much money don’t really give a shit about paying a little more money. It really just affects poorer people.

Becca:

[1:04:24] No, like…

Jewels:

[1:04:26] No, no, no. If you are a high enough income earner that you are in the highest tax bracket for capital gains taxes, that particular bracket will increase.

Taylor:

[1:04:30] Got it. Just that one is.

Jewels:

[1:04:39] However, to your original question, I would say that historically it has shown that raising the tax rate on the wealthy only causes them to change their strategy. It does not actually increase taxes, but you’ve forgotten the real job of a politician is not to increase tax revenue. It’s to get reelected by the masses. So this is really most likely pandering to the broader population where we’re like, yes, tax the rich more. Even though historically it doesn’t actually have the outcome they’re claiming it will.

Taylor:

[1:05:09] Historically it doesn’t do anything right? Remember when England tried to tax the rich more? That’s how this country started. People literally rioted.

Jewels:

[1:05:17] It’s a nice idea. And the math is beautiful on paper and it doesn’t work.

Taylor:

[1:05:33] It never works because the rich people can just hire people to get them out of it.

Jewels:

[1:05:36] Or they just move their money to the next place that has a lower…. OK, so value investing is really looking at the current price compared to the actual underlying value and buying it at a discount.

Taylor:

[1:05:47] Yeah.

Jewels:

[1:05:48] Growth investing on the other side of that is looking at the current price and predicting what you think the future value is going to be.

Taylor:

[1:05:56] Which is very hard to do.

Jewels:

[1:05:56] It’s very hard to do. But we all know like hot companies that we think have done some cool things and have really cool initiatives that they’re trying to roll out for new products and services, and as long as they do it well, we think that their price is going to go up dramatically, so buying it now and banking on them executing that plan well is sort of your growth investing strategy, so it’s higher risk, potentially higher reward. And both of those are active investing styles.

Becca:

[1:06:25] Yeah, I’ve lost so much money on so many stupid fucking stocks. It is insane, insanity.

Maggie:

[1:06:31] Just like to reiterate that index investing, not a terrible plan.

Becca:

[1:06:34] It really isn’t guys. Though the only reason I’m in the black with all of my investing is because of fucking GameStop. Like all of my profits have come from GameStop with, I think…

Taylor:

[1:06:47] That’s impressive.

Becca:

[1:06:52] Because I’ve lost so much money and all of the companies that seemed really good. Not Blackberry, but…

Taylor:

[1:06:55] Another point to uh what Maggie’s saying, the only stock that’s made me real money is Vanguard total stock index fund. Since I have

, like I bought a bunch of different ETFs and index funds. They’ve all made money, some money but the one that has made the most is the fucking BTI which is what every big investor tells you to invest in. So…

Becca:

[1:07:20] So in conclusion…

Jewels:

[1:07:21] Go back to our index funds episode.

Becca:[1:07:20] Seriously, start there, guys.

Taylor:

[1:07:21] I honestly revisit some of our episodes when I’ve forgotten. I’m lik, I should go back and listen to that episode. I do.

Jewels:

[1:07:28] Yeah, totally.

Becca:

[1:07:31] Yeah. I re-listened to the crypto episode recently.

Maggie:

[1:07:46] Which one?

Becca:[1:07:31] The crypto one. And I listened to the GameStop one recently. The Gamestop one is fun. I love that episode. It is so fun to listen to.

Taylor:

[1:07:32] I relisten to them a lot.

Jewels:

[1:07:43] There’s some really high energy.

Taylor:

[1:07:43] I know, I just like, I love the excitement.

Becca:

[1:07:45] Very high energy.

Maggie:

[1:07:46] Diamond hands rocket to the moon.

Taylor:

[1:07:48] Diamond hands, go to the moon.

Becca:

[1:07:49] Um, okay. Closing remarks, anybody about investment styles and how as long as you’re investing your investment style is correct.

Jewels:

[1:07:55] I think in summary, cash is trash. Go back and listen to the index funds episode. And then if you want to get risky with like 1% or 5% or 10% of your portfolio, depending on how risky you’re feeling, then maybe try out some active investing in whatever style you choose. Start learning about some value investing or growth investing or speculative crypto investing… do your thing.

Becca:

[1:08:30] Yeah. So if you enjoyed what you heard today, we’d love to hear from you. Please send us a message on our instagram @vaginancepodcast. Go to our website vaginance.com. We want to get a voice message from you with any thoughts you have. We’ve got all kinds of really cool show notes that Julie put up, the information on there is incredible. I refer people to that website all the time because it’s so helpful. So if you don’t want to hear our dumb voices, but you do want to read our dope information, go to the website, go there. And yeah, send us some messages. We love you so much.

Taylor:

[1:09:08] We love you.

Jewels:

[1:09:09] In the show notes this week, we will definitely include breakdowns of the different types of investing we talked about, as well as some very handy breakdowns of mortgage math. That will be much clearer than are very complicated on the cuff, off the cuff explanations.

Becca:

[1:09:23] I’m not convinced mortgage math exists. I think… I don’t know. None of it tracks.

Taylor:

[1:09:30] You make it sound like it’s, it’s like mortgage math sounds like its own like dimension of math. Like it’s literally a made up math form.

Jewels:

[1:09:34] It’s like chicken math, y’all, y’all know chicken math.

Becca:

[1:09:37] Yeah, or it’s like George Dubya fuzzy math. Where he was like, what are you even talking about? What? There is no different math. There’s just the one.

Taylor:

[1:09:55] It’s like alternative facts. You know, there’s real facts and there’s alternative facts.

Becca:[1:09:55] Yeah. Yeah. Yeah. Just alternative facts. And it isn’t even quote, Altcoin season yet, which is when things get really wild.

Taylor:

[1:10:09] Oh my God, it’s like hunting season for fucking nerds.

Becca:

[1:10:13] It is.